Best Trust Accounting Software

Best trust accounting software are Zoho Books, AbacusLaw, Clio, CosmoLex, and ONESOURCE Trust Tax. This trust management software allows for more accessible, more automated management of attorneys' trust accounts.

No Cost Personal Advisor

List of 20 Best Trust Accounting Software

Category Champions | 2024

Online accounting software for freelancers and corporates

Zoho Books is a legal trust accounting software that allows you to manage the inflow and outflow of funds seamlessly. Its features include Accounts Receivable, Bank Reconciliation, Government, Project Accounting, Expense Tracking, and Accounts Receivable. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Online document storage (back-up)

- Payment Gateway Integration

- Online invoicing

- e-Payment

- Customizable invoices

- Invoice Designer

- Accounts payable

- Payments

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

This trust account bookkeeping software makes your accounting tasks easy, fast, and secure. Start sending invoices, tracking time, and capturing expenses in minutes. We uphold a longstanding tradition of providing extraordinary customer service and building a product that helps save you time because we know you went into business to pursue your passion and serve your customers - not to learn to account. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Budgeting

- Inventory Tracking

- Customizable invoices

- Invoice Processing

- Mobile Support

- Account Tracking

- Stock Management

- Recurring invoice

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Flexible and scalable law practice management solution

AbacusLaw is a trust accounting software for lawyers that helps firms of all sizes with rules-based calendaring, form automation, and conflict checking. Other features include Contract Management, CRM, Client Portal, Task Management, and Trust Accounting. Read AbacusLaw Reviews

Explore various AbacusLaw features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all AbacusLaw Features- Billing & Invoicing

- Case Management

- Expense Tracking

- Online Payment

- Client Portal

- Account Tracking

- Calendar Management

- Client Statements

AbacusLaw Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Comprehensive law practice management solution for lawyers

Clio is a trust accounting software for law firms that helps you manage your firm from anywhere, anytime. This trust accounting software for banks enables you with Billing & Invoicing, Calendar Management, Conflict Management, and Time Tracking. Read Clio Reviews

Explore various Clio features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Clio Features- Client Management

- Inventory Management

- Task Management

- Billing & Invoicing

- Client Statements

- Expense Tracking

- Physician Scheduling

- Document Management

Pricing

Starter

$ 39

User/Month

Boutique

$ 59

User/Month

Elite

$ 99

User/Month

Clio Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Maximum efficiency and compliance for law firms

CosmoLex is a popular legal trust software that helps law firms improve the efficiency and productivity of their operations. This platform offers CRM, Legal Case Management, Trust Accounting, Document Management, Conflict Management, and more. Learn more about CosmoLex

Explore various CosmoLex features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CosmoLex Features- Client Statements

- Bank Reconciliation

- Mobile Access

- Accounts payable

- Billing & Invoicing

- Time Tracking

- Calendar Management

- Accounts Receivable

Pricing

Basic

$ 59

User/Month

CosmoLex Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Seamless automation and control over tax processes

ONESOURCE Trust Tax is trust accounting software for banks that allows you to automate your entire bringing and tax return process. In addition, this trust accounting software for banks provides you with Tax Management and Compliance Management capabilities. Learn more about ONESOURCE Trust Tax

Explore various ONESOURCE Trust Tax features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Compliance Management

- Tax Management

ONESOURCE Trust Tax Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Web-based management and reporting software for attorneys

TrustBooks is a trust accounting software for lawyers designed specifically for solo attorneys and small law firms. Some of the key features of this platform include compliance management, customer statements, check writing, and tax management. Learn more about TrustBooks

Explore various TrustBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TrustBooks Features- Compliance Management

- Customer Statements

- Check Writing

TrustBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Financial management system for small-medium size organizations

Sage Intacct is a legal trust accounting software for accountants that helps CFOs and other executives to integrate and manage financial reports across business entities. It provides Bank Reconciliation, Fixed Asset Management, Fund Accounting, and Tax Management. Read Sage Intacct Reviews

Explore various Sage Intacct features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Intacct Features- Sales Tax Management

- Revenue Management

- Fund Management

- Payroll Management

- Nonprofits

- Inventory Management

- Accounting

- Version Control

Sage Intacct Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Cloud-based compliance and financial management software

Trust Accounting is an accounting software for trusts that helps you with compliance management, activity tracking, receipt management, and more. It is a SaaS application that helps you manage cash, orders, and accounts. Learn more about Trust Accounting

Explore various Trust Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Trust Accounting Features- Cross Ledger Posting

- Tax Management

- Check Writing

- Customer Statements

- Receipt Management

- Activity Tracking

- Fee Calculation & Posting

- Compliance Management

Trust Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is India’s leading trust account software for GST, accounting, inventory, banking, and payroll. TallyPrime is affordable and is one of the most popular business management software used by nearly 20 lakh businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Voucher Management

- Outstanding

- Cash Management

- Budgeting

- GST returns

- Accounting Integration

- Live Chat

- Email Integration

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Private wealth management for law firms/practitioners

Troika is one of the best trust accounting software for professionals that manage private wealth. Some key features of this platform are Asset Gain & Loss Reporting, Compliance Management, Fee Calculation & Posting, and more. Learn more about Troika

Explore various Troika features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Troika Features- Compliance Management

- Customer Statements

- Receipt Management

- Activity Tracking

- Fee Calculation & Posting

- Cross Ledger Posting

- Asset Gain & Loss Reporting

Troika Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Web-based solution for trust accounting professionals

MAUI is an online trust software that enables you to manage account balances, transaction history, and other general account information. It offers all trust accounting features, ranging from Accrual Accounting to Tax/Receipt Management. Learn more about MAUI

Explore various MAUI features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all MAUI Features- Compliance Management

- Accrual Accounting

- Tax Management

- Receipt Management

- Check Writing

- Cross Ledger Posting

- Asset Gain & Loss Reporting

- Activity Tracking

MAUI Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Trust Accounting Software for accountants

TrustNet is a free trust accounting software for trustees, IRA companies, law offices, CPA firms, special needs trusts, guardianships, family offices, Indian tribes, etc. It can install on Windows. They offer a free product demo on request. Learn more about TrustNet

Explore various TrustNet features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TrustNet Features- Asset Gain & Loss Reporting

- Tax Management

- Accrual Accounting

- Compliance Management

- Activity Tracking

- Customer Statements

- Receipt Management

- Check Writing

TrustNet Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Trust and investment management accounting software

AccuTrust Gold is a trust management software that features accrual accounting, asset gain & loss reporting, compliance management, customer statements, receipt management, activity tracking, check writing, cross-ledger posting, and tax management. Learn more about AccuTrust Gold

Explore various AccuTrust Gold features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all AccuTrust Gold Features- Accrual Accounting

- Receipt Management

- Activity Tracking

- Asset Gain & Loss Reporting

- Cross Ledger Posting

- Fee Calculation & Posting

- Tax Management

- Customer Statements

AccuTrust Gold Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Sage

Sage offers the best trust accounting software that helps you spend less time managing your accounts and more time developing your business. With its easy-to-use interface, Sage 50cloud Accounting has aided small businesses and entrepreneurs to operate efficiently and effectively. Special Offer: 40% off Sage 50cloud annual subscriptions | Coupon Code: D-1929-0020. Read Sage 50cloud Reviews

Explore various Sage 50cloud features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage 50cloud Features- Fixed Asset Management

- Purchase Orders

- Payment Processing

- Revenue Recognition

- Online invoicing

- Bank Reconciliation

- Billing & Invoicing

- Contact Database

Pricing

Pro Accounting

$ 51

Per Month

Premium Accounting

$ 78

Per Month

Quantum Accounting

$ 198

Per Month

Sage 50cloud Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

LEAP is the best system for lawyers and staff to w

LEAP is a trust accounts management for law firms. LEAP includes matter management, automated legal forms, email management, automatic time recording, trust accounting, billing, office reporting, and a client service portal in one system for one price. Read LEAP Legal Reviews

Explore various LEAP Legal features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all LEAP Legal Features- Encryption

- Trust Accounting

- Todo lists

- Retainer Billing

- Contact management

- Billing & Invoicing

- Billable Hours Tracking

- Law Firms

LEAP Legal Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Exhibit One Software

TotalTrust is a fully featured software for trust accounting designed to serve Agencies, Startups. TotalTrust provides end-to-end solutions designed for Windows. This online accounting system offers Asset Gain & Loss Reporting and Receipt Management in one place. Learn more about TotalTrust

Explore various TotalTrust features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TotalTrust Features- Receipt Management

- Asset Gain & Loss Reporting

TotalTrust Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by FASTER Systems

FASTER is a fully featured trust account management software designed to serve Agencies, Enterprises. FASTER provides end-to-end solutions designed for Windows. This online Trust Accounting system offers Accrual Accounting, Asset Gain & Loss Reporting, and Tax Management in one place. Learn more about FASTER

Explore various FASTER features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FASTER Features- Tax Management

- Asset Gain & Loss Reporting

- Accrual Accounting

FASTER Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by enSynergy Professional Services

Integrated financial CRM and compliance software. Party-centric design provides a 360-degree perspective of client data. Integrated rules-based user notifications for erroneous data and rule violations. Add our LiveFile document management module to achieve integrated document management. Scalable design to match your budget and business size. Other modules include trust and company administration/accounting, corporate accounting, practice management/time recording, and enterprise billing. Learn more about enVisual WealthDesk

Explore various enVisual WealthDesk features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Receipt Management

- Activity Tracking

- Check Writing

- Cross Ledger Posting

- Accrual Accounting

- Customer Statements

- Fee Calculation & Posting

- Tax Management

enVisual WealthDesk Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Trust Accounting?

Trust account is the bookkeeping of trust accounts according to state requirements. The state has its list of rules that the trust account should adhere to, and the trust accounting process would help the clients or law firms to maintain accurate records and manage the accounts.

What is Trust Accounting Software?

Trust accounting has recently been highly reliable on definite bookkeeping rules. That’s why most law firms and lawyers choose free trust accounting software for trustees instead of manual processes. The software will help with

-

Deposit tracking and disbursement tracking that happens through the trust account

-

Keeping a ledger containing information on each and every transaction made with clients

-

Keeping a journal for accounting

-

Recurring reconciliation

Keeping track is not as easy as said on paper. Every transaction should be monitored, managed, and supported by appropriate paper trails. Instead of trust account management software, why not utilize standard accounting software?

With trust funds, the dangers of incorrect management are greater. Due to inconsistencies in the record, some lawyers have had their licenses revoked. As a result, tracking transactions across various accounts, investment management portfolios, estates, and other entities is much easier to manage with the help of trust accounting software.

Why do You Need Trust Accounting Software?

Trust accounting software manages and tracks a trust account's financial transactions. These transactions include deposits, withdrawals, funds transfers, and the allocation of income and expenses. Trust accounting software is necessary for several reasons:

-

Compliance

Software for trust accounting assists in ensuring adherence to legal and regulatory standards for trust accounting. This includes keeping track of transactions, keeping correct records, and producing reports needed by authorities and professional associations.

-

Record-keeping

You may maintain precise records of all financial transactions involving trust accounts with trust accounting software. This includes monitoring the allocation of income and expenses as well as deposits, withdrawals, and money transfers.

-

Auditing

Trust accounting software provides an audit trail of all financial transactions, which can be used to detect and prevent fraud. Moreover, it helps in the reconciliation of accounts and the preparation of financial statements.

-

Time-saving

Many trust accounting functions, including data entry and report production, are automated by trust accounting software, which can speed up operations and save labor costs.

-

Security

Trust accounting software provides a secure platform for handling confidential financial data and transactions with features including data encryption, access limits, and disaster recovery.

-

Multi-user access

Multiple users, including managers, trustees, and accountants, can access and edit information in real time using trust accounting software, which can enhance collaboration and decision-making.

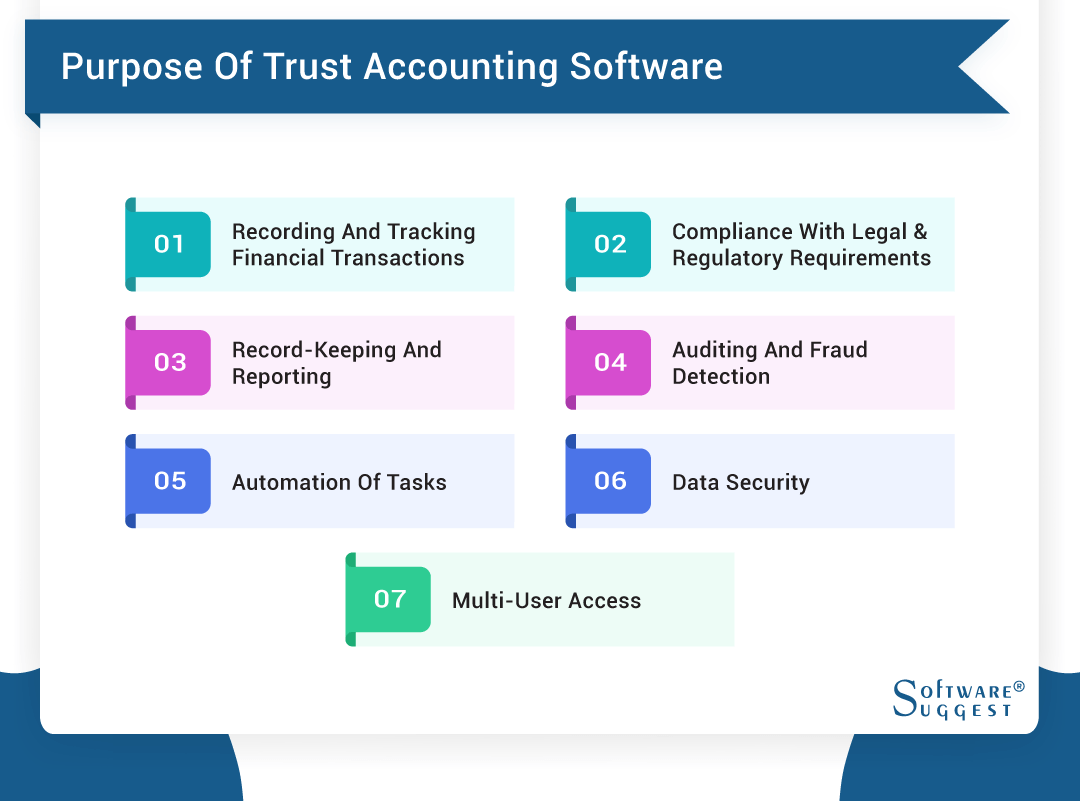

What is the Purpose of Trust Accounting Software?

It is vital to choose the right trust accounting software that meets your business requirements. The following are the purposes of using trust accounting software.

-

Recording and tracking financial transactions

Trust accounting software enables you to record and monitor any transactions involving money, including deposits, withdrawals, and transfers, that are connected to trust accounts.

-

Compliance with legal and regulatory requirements

By recording transactions, maintaining accurate records, and creating reports required by governmental organizations and professional associations, trust accounting software assures compliance with legal and regulatory obligations linked to trust accounting.

-

Record-keeping and reporting

Using trust accounting software, you may generate reports like balance sheets, income statements, and cash flow statements while maintaining precise records of all financial activities involving trust accounts.

-

Auditing and fraud detection

The audit trail of every financial transaction is provided by trust accounting software, which can be used to spot and stop fraud. Additionally, it aids in the creation of financial statements and account reconciliation.

-

Automation of tasks

Trust accounting functions, including data entry and report production, are automated by trust accounting software, which can speed up operations and save labor costs.

-

Data security

With features like data encryption, access limits, and disaster recovery, trust accounting software offers a safe platform for managing private financial data and transactions.

-

Multi-user access

Trust accounting software allows multiple users, such as managers, trustees, and accountants, to access and update information in real time, improving collaboration and decision-making.

How to Choose the Best Trust Accounting Software?

How do I pick the best accounting software for trust? Do you intend to improve your management procedure? Or are you making your first decision about trust accounting software? It is not a one-step process, though. Here is all the information you require to purchase trust accounting software.

-

Assess requirements

The legal trust accounting software should solve the trust accounting problems you have at hand. Check your requirements in terms of

- Accounting and Reporting

- Cost tracking

- Debtor control

- Compatibility with the firm’s current IT architecture

- Format for licensing

- Database access and research tool

- Archiving – cloud storage, electronic records, and others

Cost of the software: Yes, because legal trust accounting software is cheap, it does not mean it is inadequate. However, you would have additional expenses after paying for the trust accounting software for lawyers at first In general, apart from the license cost, you will embrace maintaining the software, changing the architecture, upgrading the capacity, and the cost of security or backup software, and the cost of support.

-

Implementation ease

The most effective trust accounting software should be simple. Can data from your previous system be migrated to the new software? Can the old system still serve as a backup? Does your staff need specific training to use the best trust accounting software? What are the processes for reporting, managing, and documenting? It's challenging for lawyers to transition to new trust accounting software. However, if you opted for the one with a simple implementation and interface, the shift would go more smoothly.

-

Features

The best trust accounting software does not currently have every function. It all depends on what you need for your business at the moment. If you don't require half of the capabilities offered by the best trust accounting software for lawyers, you don't have to spend much money on it. Don't forget to look for features such as output type, transaction document or report analysis, backup, and recovery

-

Scalability

Trust accounting systems cannot be often changed. As a result, you need the appropriate tools to grow your business. It is crucial to consider scalability while selecting trust accounting software for banks.

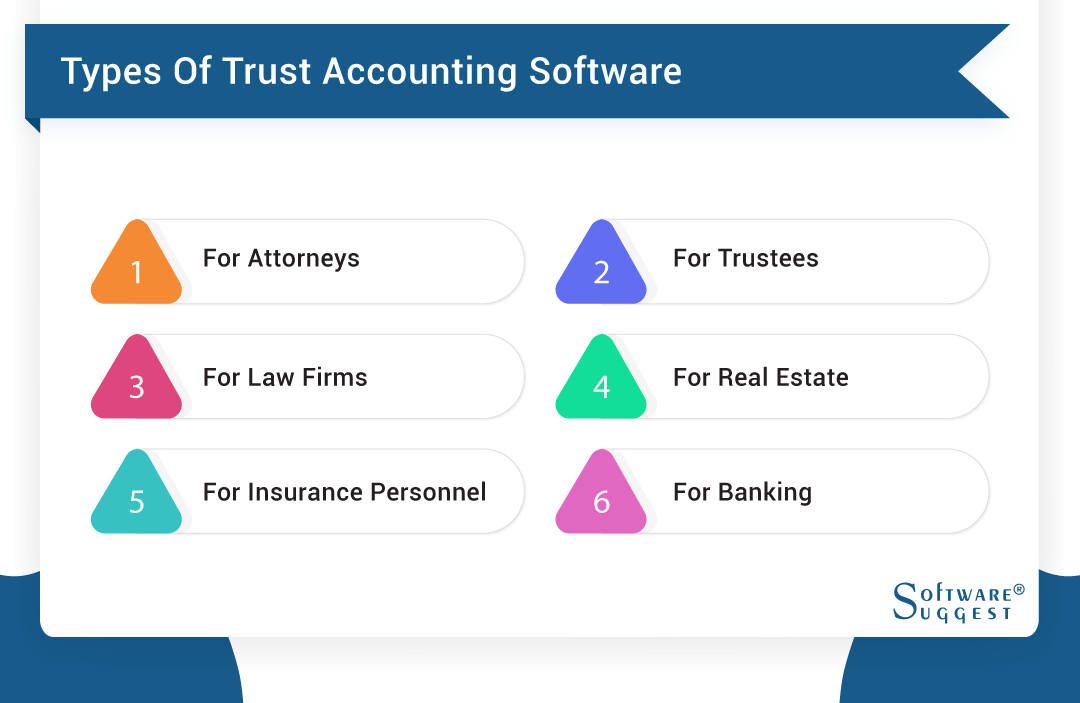

Types of Trust Accounting Software

There are many types of trust accounting software available in the market. The target market determines the kinds of trust accounting systems available.

-

For attorneys

The Attorney trust accounting software will help the lawyer manage, reconcile, and track the trust accounts.

-

For trustees

If you are one of the trustees, you ought to choose the trust accounting software for trustees. The best trust accounting software for trustees would help with an investment portfolio, guardianship, and others. It is best for trust companies, family offices, charities, and others.

-

For law firms

The legal trust accounting software for law firms and solo attorneys differs in its capability and the type of features that add value to the software. If you choose legal trust accounting software for your law firm, the package focuses on accounting, practice management, billing, and others.

Some companies choose specialized legal trust accounting software with features like contact management, matter management, rules-based calendaring, tracking time, form automation, and others. Such high-end trust accounting systems come with private cloud features and backup disaster-proof.

-

For real estate

If you are choosing trust accounting software for real estate, you can find features like activity tracking, compliance management, receipt management, customer statement, tax management, fee calculation, cross-ledger posting, and others..

-

For insurance personnel

Trust accounting system helps insurance agencies with commission tracking, percentage commission, compliance management, and others.

-

For banking

If you choose the trust accounting software for banks, you will receive features for banking integration, accounting, barcode integration, and others.

It is not that you should not choose a general trust accounting software if you are in real estate. However, trust accounting software for real estate will provide better features for real estate agents rather than trust accounting software for trustees

Benefits of Trust Accounting Software

Trust accounting software can give businesses an edge and increase productivity exponentially. Whether trust accounting software is for real estate or trustees, there are multiple benefits of trust accounting software.

-

Improves overall efficiency by reducing the time to manage the trust accounts.

-

The best trust accounting system will provide sufficient internal controls.

-

If you are choosing the real estate trust accounting software, you could generate customized reports to meet your firm's and your client's needs. In the case of banking trust accounting software, the reporting features would be different.

-

Easy, faster, and fully-functional reconciliation process. Some software helps to create three-way reconciliation.

-

Audit trails become easier, thereby increasing the transparency of your practice. This transparency helps to maintain morale and also increases your brand value.

-

Each state has its regulations for managing and handling trust accounts. The software helps in compliance with the regulations of the state. It helps to reduce the risk inherent in this genre of accounting.

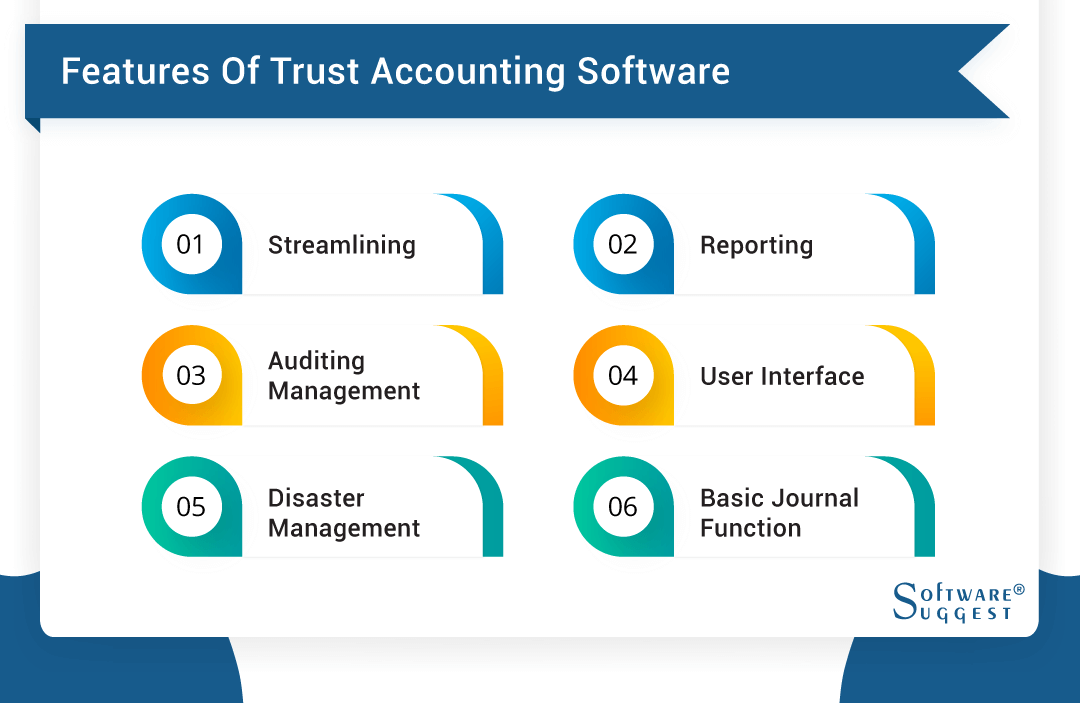

Features of Trust Accounting Software

Trust accounting software come packed with many innovative features. Choosing the right trust accounting software with the required features to meet your business needs is important. Some important features of trust accounting software include:

-

Streamlining

The software you choose for trust accounting, regardless of the type, should be able to streamline the process and improve efficiency. This primary feature should be in all trust accounting systems like real estate trust accounting software, banking trust accounting software, and others

-

Reporting

Every client would need specific reports. Individual firms need daily reports for analysis and filing. The trust accounting software comes with a customizable report generation feature. These reports are also adaptable and comprehensive.

-

Auditing Management

The software can track receipts and transactions and store them for audit. The auditing process is also gets managed by the software. It adds internal control and sufficient accounting safeguard to your practices.

-

User interface

If you choose real estate trust accounting software, the software comes with a user interface or portals for the landlord, tenant, build-in inspection app, and others.

-

Disaster management

All the trust accounting systems come with backup in an electronic database and cloud. This backup helps in retrieving data effectively during a disaster or cyberattack.

-

Basic journal function

The software also comes with basic journal functions that allow the movement of funds between the accounts, if needed. These are just the basic features. You can find other customized features based on the type of accounting system you choose, like real estate (real estate software) trust accounting software.

Considerations When Buying Trust Accounting Software

It is important to scan the market if you are planning to invest in trust accounting software. When buying trust accounting software, there are several considerations to keep in mind to ensure that you choose the best solution for your business:

Multicurrency functionality

As the software enables you to handle trust accounts in many currencies, the multicurrency capability is a crucial factor to take into account when purchasing trust accounting software. When comparing the multicurrency capacities of various software alternatives, bear the following in mind:

-

Currency conversion

The software should convert currencies automatically, allowing you to handle trust accounts in several different currencies without calculating exchange rates manually.

-

Updates to exchange rates

The program should be able to do this automatically so that you always have the most recent information.

-

Financial reporting

To readily evaluate how your trust accounts function in several currencies, look for software that provides financial reports in numerous currencies.

-

Multi-language support

If you work with clients from other nations, multicurrency functionality is essential. Check that the program is multilingual.

-

Bank integration

Check the software's ability to link with banks that accept numerous currencies to handle trust accounts in many currencies easily.

-

Handling different accounting standards

As different countries have different accounting standards, ensure that the software can handle the accounting standards of the different currencies you will be working with.

Look whether the software provides bank reconciliation

When choosing trust accounting software, it's crucial to take bank reconciliation into account because it enables you to confirm that the information in your trust account and your bank's records are identical. When comparing the bank reconciliation features of various software alternatives, bear the following:

-

Automated bank feed

To effortlessly reconcile your trust account records with your bank statements, look for software that can automatically import transactions from your bank.

-

Matching transactions

The software should be able to match transactions between your trust account records and your bank statements, so you can easily identify any discrepancies.

-

Reconciliation reports

Consider the software that can generate detailed reconciliation reports so that you can check the status of your trust account reconciliations at a glance.

-

Multi-bank support

If you have various trust accounts with various banks, be sure the program can reconcile them all.

-

Customizable rules

To readily handle any unexpected transactions or exceptions, the program should let you build up personalized rules for reconciling transactions

-

Handling of different currencies

The software should be able to reconcile trust accounts in multiple currencies so that you can ensure that your books are accurate and in compliance with regulatory requirements.

-

Integration with other software

Look for software that can integrate with your existing software, such as your accounting software, to avoid data entry duplication and improve efficiency.

Assessment of security

It's critical to consider security while buying trust accounting software to safeguard private financial data. To do this, evaluate the software:

-

Data encryption

Assure that the software encrypts all data stored in the system, both in transit and at rest.

-

Access controls:

Validate that the software has robust access controls, such as two-factor authentication, to prevent unauthorized access to financial information.

-

Audit trails

Evaluate whether the software maintains an audit trail of all financial transactions, including who made the transaction, when it was made, and what was changed.

-

Backup and disaster recovery

Confirm that the software has a robust backup and disaster recovery plan to protect against data loss in the event of a system failure or natural disaster.

-

Compliance

Confirm that the software complies with industry regulations such as SOC2, PCI-DSS, GDPR etc.

Top 5 Trust Accounting Software

Investing in the best trust accounting software can help organizations enhance operational efficiency and gain an instant competitive advantage. Below mentioned are the top 5 trust accounting software.

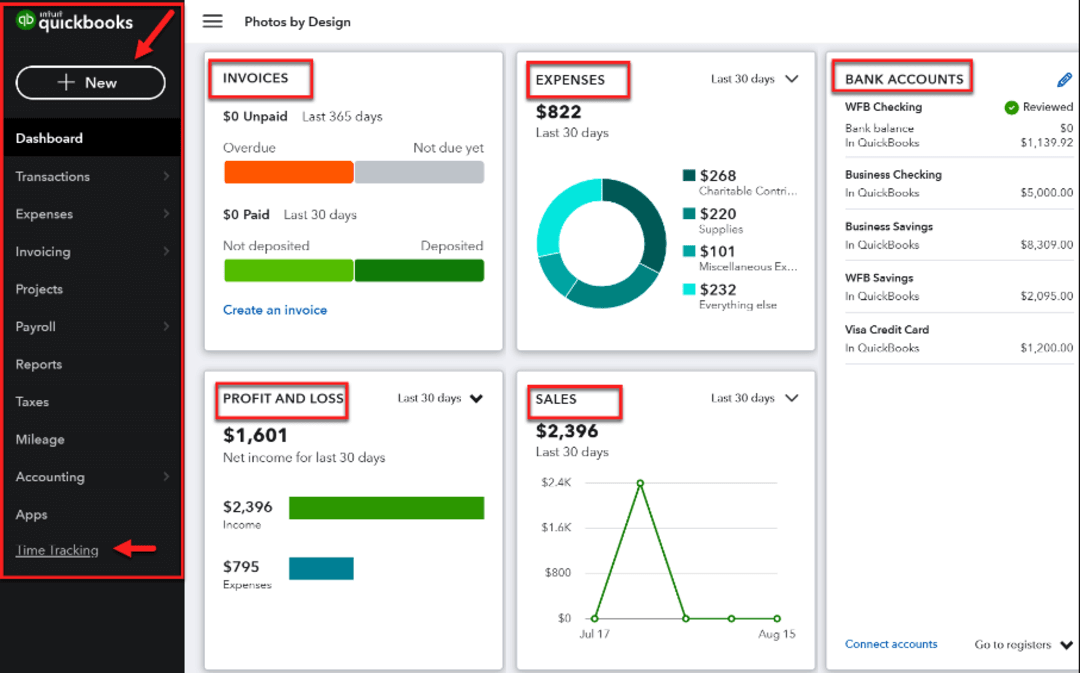

1. Quickbooks Online

QuickBooks Online can be a trust accounting software for legal and financial experts. Users can create and manage trust accounts, monitor trust earnings and outgoings, produce trust reports, and adhere to state-specific trust accounting rules.

Features

- Separate trust and operating accounts

- Track trust income and expenses

- Generate trust reports, such as trust account reconciliations

- Set up trust account rules and restrictions

- Comply with state-specific trust accounting regulations

- Support for multiple trust accounts and clients

Pros

- QuickBooks Online is user-friendly and easy to navigate

- Accessible from anywhere

- Provided automated features such as generating financial reports

- Can integrate with other financial and accounting software

- It allows multiple users to access and collaborate on the same trust accounts

Cons

- Limited customization doesn't fully meet unique trust accounting needs

- Subscription-based so it can be costly

- Limited support for some state regulations

- Not suitable for large organizations

Pricing

- Simple Start plan starts at $25 per month

- Advanced plan starts at $150 per month

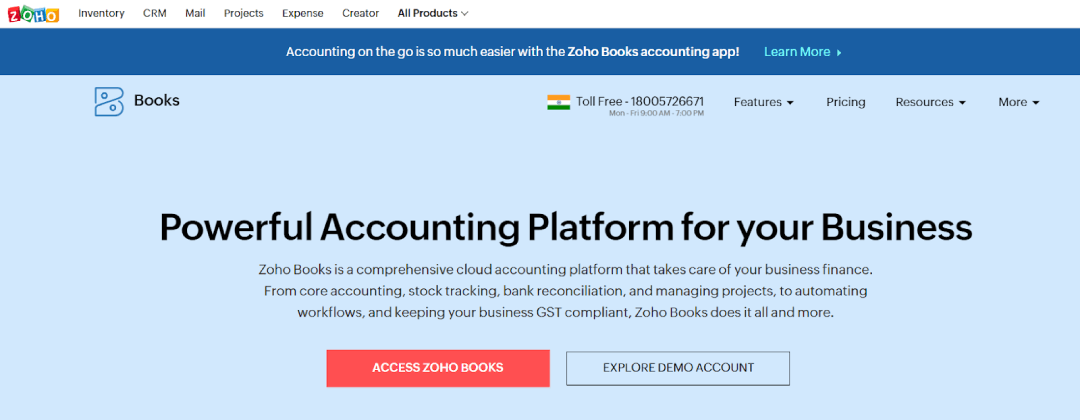

2. Zoho Books

The cloud-based accounting software Zoho Books was created by the Zoho Corporation. It is made to help small enterprises and independent contractors handle their accounting and financial tasks. For those in the legal and financial industries, it can also be utilized as trust accounting software. Users can make and manage trust accounts, monitor trust earnings and outgoings, produce trust reports, and adhere to state-specific trust accounting rules.

Features

- Separate trust and operating accounts

- Track trust income and expenses

- Generate trust reports, such as trust account reconciliations

- Set up trust account rules and restrictions

- Comply with state-specific trust accounting regulations

- Support for multiple trust accounts and clients

- Multicurrency support

- Invoicing, expenses and purchase order management

- Bank and credit card integration

- Mobile App available

- Time tracking

- Tax compliance

Pros

- Simple, intuitive, and user-friendly interface

- Support for several currencies

- Integration with other Zoho software

- Reasonable pricing for small enterprises

Cons

- Insufficient inventory management

- limited alternatives for reporting

- Customer support is scarce

- Few integrations with outside parties

Pricing

- Basic plan starts at $9 per organization per month

- Professional plan price at $29 per organization per month

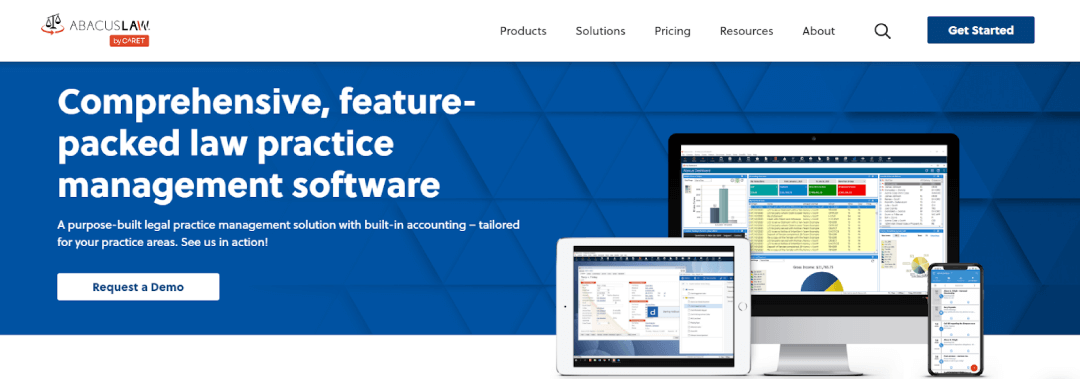

3. AbacusLaw

AbacusLaw is a law practice management software that includes features for trust accounting, such as trust account management, trust ledger, and trust reporting. Moreover, features such as case management, document management, and billing and invoicing are also available.

Features

- Manage trust accounts, track trust ledger and generate trust reports

- Track cases, schedule appointments, and manage deadlines

- Allow users to store, organize, and retrieve documents electronically

- Allow users to create and send invoices, track payments, and generate financial reports

- Users can store and manage contact information for clients, vendors, and other contacts

- Calendar and scheduling

- Reporting and analytics

- Cloud-based and mobile access

Pros

- The software is easy to use and navigate

- Provide features like billing and invoicing, and calendar and scheduling

- Can be integrated with other software, such as Microsoft Office

- Including case management and document management

Cons

- Can be expensive, especially for small law firms with limited budgets

- Compatible with Windows operating systems, and not Mac or mobile

- Limited functionality

- Limited technical support

Pricing

- Basic plan starts at $49 per user per month

- Premium plan starts at $99 per user per month

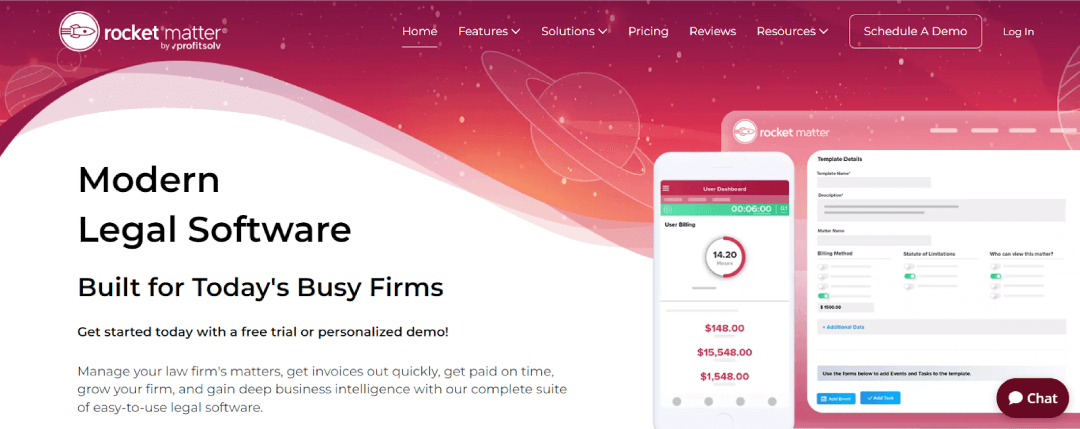

4. Rocket Matter

Rocket Matter is a legal practice management software that includes trust accounting capabilities. It is designed to help law firms manage their trust accounts, track client funds, and comply with legal and ethical requirements related to trust accounting.

Features

- Allows users to set up multiple trust accounts, track client funds, and generate trust account reports

- Helps users comply with legal and ethical requirements related to trust accounting

- Provides real-time visibility into trust account balances, transactions, and other key information

- Integrates with other Rocket Matter features such as case management

- Uses bank-level security to protect client funds and keep them secure

- The software is mobile accessible which allows for access to trust account information from anywhere

Pros

- The software is modifiable

- It can be combined with other programs, such as Microsoft Office, to increase productivity

- Because the software is cloud-based, it may be accessed from any location

- Portable compatibility

- Uses bank-level security to safeguard and protect customer funds

Cons

- Can be expensive, especially for small law firm

- Limited technical support

- Limited reporting

Pricing

- Standard plan starts at $39 per user per month

- Ultimate plan starts at $69 per user per month

5. Tabs3

Tabs3 Trust Accounting software is a feature of Tabs3 legal practice management software and is made to assist law firms in managing their trust accounts, tracking client cash, and adhering to trust accounting-related legal and ethical obligations.

Features

- Assists users in adhering to the legal and moral criteria for trust accounting

- Integrates with other Tabs3 capabilities, including case management, document management, and billing and invoicing

- Uses bank-level security to safeguard and protect customer cash

- The software enables users to alter their workflow to best suit their unique requirements

- Offers a variety of reports that may be utilized to assess financial information, case details, and other important indicators

Pros

- The software allows storing, organing, and retrieving documents related to their cases

- Tools for creating and tracking invoices and payments can help firms stay on top of their finances

- The calendar features like scheduling appointments and deadlines

Cons

- The software has many features which can make it difficult for users to learn, use and navigate

- Provide limited integration options

- The software is a paid one so it can be expensive for small-scale firms

- Limited cloud version which can be inconvenient for remote jobs

Pricing

- Single user can range from $200 to $400

- Multi-user licenses can cost $1,000 to $3,000 or more

How To Implement Trust Accounting Software?

Implementing trust accounting software is simple; however, organizations must keep some important aspects in mind before choosing one. Implementing trust accounting software involves several steps, including:

-

Identifying your needs

Establish the specific trust accounting needs and criteria of your organization. This process includes assessing the types of trust accounts you handle, the quantity and complexity of transactions, and any compliance needs.

-

Research software options

Investigate and compare several trust accounting software choices based on your needs and requirements. Look at the features, functions, and cost, and read other users' reviews.

-

Select and purchase software

Select the software that best meets your needs.

-

Set up and configure the software

Once the software has been purchased, adjust it to meet the unique demands of your firm. This may entail setting up user accounts, modifying the software's settings, and connecting it to other platforms like your accounting program or banking institutions.

-

Data migration

Plan for the data migration process if you're switching from another piece of software. Data from the old system may need to be exported, cleaned up, organized, and imported into the new system.

-

Training

Provide training to the software users, such as trustees, accountants, and managers, to ensure they can use it effectively.

-

Testing

Test the software to ensure it is working correctly and that all data has been migrated correctly.

-

Go Live

The software is ready to be used in production after the testing phase. Make sure to have a plan in place for support and maintenance.

Challenges Faced While Using Trust Accounting Software

Some issues faced while using a trust accounting software:

-

Compliance

The software adheres to a number of laws and regulations which can be a challenging and time-consuming task.

-

Data security

Trust accounting software includes private financial data; therefore it's crucial to ensure it's shielded from illegal access. This can be a significant problem, especially for smaller businesses that might lack the funding for serious security investments.

-

Data migration

When switching to a new trust accounting software, migrating data from the old system can be a time-consuming and error-prone task. This can be especially challenging if the data is stored in multiple formats or locations.

-

User-friendliness

Trust accounting software can be complicated and difficult to use without specialized understanding. Some software may struggle with usability and simplicity, resulting in low adoption rates and constrained productivity.

-

Limited features

Some trust accounting software may lack the features required to properly automate the process, necessitating manual intervention and raising the possibility of mistakes.

Future of Trust Accounting Software

It is essential to stay abreast of the latest developments in the field of trust accounting software. Some of the trends and developments that are likely to shape the future of trust accounting software include:

-

Cloud-based options:

Users may access their data and applications from any location and on any device, thanks to the growing popularity of cloud-based trust accounting software. This increases flexibility and accessibility while potentially lowering hardware and IT support expenses.

-

Artificial intelligence and machine learning

These technologies can be used to automate tasks, improve data analysis, and reduce the risk of errors. This can help legal firms to increase productivity, reduce costs and improve compliance.

-

Mobile integration

Mobile integration allows users to access trusted accounting software from their smartphones and tablets, which can improve accessibility and flexibility.

-

Security

As cyber threats continue to increase, trust accounting software providers are likely to invest more in security features to protect sensitive financial information from unauthorized access.

-

Compliance

With more laws and regulations being put in place, trust accounting software providers are likely to invest more in compliance features to help legal firms stay compliant.

-

Integration with other systems

Trust accounting software is likely to integrate with other legal software, such as billing and document management systems, to improve automation and efficiency.

Market Trends To Understand

The rising significance of financial regulation and the necessity for transparency in financial transactions, there is also a rising market demand for trust accounting software that can fulfill the complex and complicated requirements of the clients and provide the best outcomes.

-

Mobile functionality

Some of the specific market trends of trust accounting software related to mobile functionality include:

1. Improve adoption of mobile-responsive designs

2. Development of mobile apps that can be downloaded and used on smartphones or tablets

3. Increased use of mobile payments

-

Cloud-Based Software

Some of the specific market trends related to cloud-based trust accounting software include:

1. Increased adoption of cloud-based solutions

2. Development of SaaS (Software as a Service) model

3. Increased use of API (Application Programming Interface)

4. Improved data security

Conclusion

Therefore, trust accounting software is a type of software that is specifically designed for legal professionals to manage trust accounts that allow easy management of accounts, reporting, tracking and help the trust to make wiser decisions.

By Countries

.png)

.png)