Best Budgeting Software

The best budgeting software for small businesses are PocketGuard, Quicken, Honeydue, Intuit Mint, and Goodbudget. Small business budgeting software helps businesses to create, manage, monitor, and track their budget.

No Cost Personal Advisor

List of 20 Best Budgeting Software

Category Champions | 2024

Online Accounting Software for Growing Businesses

Zoho Books is a great budgeting software for managing the finance of your business. The software provides end-to-end accounting functionalities, including GST invoicing, audit trails, core accounting, stock monitoring, expense tracking, bank reconciliation, and financial reporting. Zoho Books creates GST invoices and files tax returns directly, ensuring your business is always GST-compliant. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Banking Integration

- Dashboard

- Taxation Management

- Inventory Management

- Project Accounting

- Time Tracking

- Purchasing

- Refund Management

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Making Modern Businesses GST friendly

QuickBooks is an online budgeting software for business owners to keep them on top of their finances. Its easy-to-use interface, 100% data security, and streamlined workflows help owners focus more on their growing businesses. QuickBooks is well-known for its features like budgeting, forecasting, expense management, vendor management, GST compliance, document management, etc. Read QuickBooks Online Reviews

Explore various QuickBooks Online features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all QuickBooks Online Features- Timesheets

- GST returns

- Billing System

- Project Management

- Receipt Management

- Purchasing

- Client Portal

- Retainer Billing

Pricing

Simple Start

$ 30

Per Month

Essentials

$ 60

Per Month

Plus

$ 90

Per Month

QuickBooks Online Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by You Need A Budget

You Need a Budget (YNAB) is the best budgeting software for designing and maintaining a budget. This user-friendly software helps you manage your relationship with money with its flexible budgeting solutions. With the YNAB money management system, you will save effortlessly and spend confidently by simplifying your spending decisions. Learn more about You Need A Budget (YNAB)

Explore various You Need A Budget (YNAB) features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Profit / Loss Statement

- Capital Asset Planning

- General Ledger

- Project Budgeting

- Cash Management

- Run Rate Tracking

- Balance Sheet

- Forecasting

You Need A Budget (YNAB) Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by The Infinite Kind

Keep an eye on your cash flow with Moneydance. It is an advanced budget management software that lets you create a budget and helps you stick to it. Moneydance offers a wide range of features, such as online banking, reporting, account registers, portfolio management, and more. Read Moneydance Reviews

Explore various Moneydance features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Moneydance Features- Profit / Loss Statement

- Income Statements

- Forecasting

- Capital Asset Planning

- General Ledger

- Balance Sheet

- Multi Company

- Cash Management

Pricing

Starter

$ 50

Per Month

Moneydance Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Software by ClearTax

ClearTax is a complete corporate budgeting software that helps businesses with finance management and helps them save time and money. It provides almost all the features that you wish for in budgeting software, including GST compliance, e-invoicing, e-way bill, ITR filing, tax consulting, payment tracking, stock management, and much more. Read ClearTax Reviews

Explore various ClearTax features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ClearTax Features- Dashboard

- Data Import/Export

- Records of E-Way Bills

- Audit Trail

- Email and SMS Alerts

- E-Way Bill Generation

- Inventory Management

- Reporting

ClearTax Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by CountAbout

Keep a tab on your savings and expenses with CountAbout. It is an all-in-one enterprise budgeting software that helps you pay off debt faster or reach your savings goals sooner by making small differences in your budgeting. CountAbout enables you to identify leaks in your spending and ensures you control your finances. Learn more about CountAbout

Explore various CountAbout features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CountAbout Features- Balance Sheet

- General Ledger

- Income Statements

- Cash Management

- Profit / Loss Statement

- Forecasting

- Multi-Department

- Project Budgeting

Pricing

Basic

$ 10

Per Year

Premium

$ 40

Per Year

CountAbout Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

The next generation Online Accounting Software

ProfitBooks is a top budgeting software for gaining full control over your business finance. The software lets you easily manage all your transactions in one place with unique features like sales order, task, and document management. ProfitBooks is highly secure as it enforces five levels of security measures for data protection and secure access. Read ProfitBooks Reviews

Explore various ProfitBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ProfitBooks Features- Inventory Management

- Security

- Payments

- Manage Customers and Suppliers

- Multi Layer Security

- Multi Currency Support

- Database backup/restore (Management)

- Taxation Management

Pricing

Professional Plan

$ 83

Per Year

SMB Plan

$ 125

Per Year

ProfitBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Books that make sense

Giddh is the best business budgeting software that offers services like GST compliance, bank reconciliation, cash management, bulk vendor payments, Tally plug-in multicurrency, audit trail, invoicing, reporting, analysis, etc. Unlike other software, it is simple, flexible, and has no restrictions on users. Change the shape of your business with Giddh’s smart budgeting. Read Giddh Reviews

Explore various Giddh features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Giddh Features- For Real Estate

- Online Invoice Payment

- General Ledger

- Labor Projection

- Recurring/Subscription Billing

- Court Management

- Account Management

- Fast Search

Pricing

Birch

$ 21

Per Company/Yearly

Oak

$ 56

Per Company/Yearly

Vine

$ 139

10 Companies/Yearly

Giddh Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

All-in-One Platform to Run Your Business.

Deskera is a next-generation budget planning software that helps you drive scalable costs and improved margins. With its modern, centralized, and integrated business processes, you can organize your finance as per your needs and keep a tab on accounting and transactional activities with a complete audit trail. Deskera offers effortless budgeting for businesses of all sizes. Read Deskera Reviews

Explore various Deskera features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Deskera Features- Analytics

- Accounts Receivable

- Financial Reporting

- Activity Tracking

- Order Management

- Check Processing

- Bills of Material

- Mobile Support

Pricing

Professional

$ 83

User/Month

Startup

$ 17

User/Month

Essential

$ 42

User/Month

Deskera Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Prophix Software

Prophix is the best online budgeting software that helps you create and maintain a budget for your finances. The software streamlines budgeting and planning processes with greater speed, accuracy, and agility. Prophix saves time with improved collaboration and keeps everyone engaged and aligned with unified planning. Learn more about Prophix Software

Explore various Prophix Software features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Prophix Software Features- Profit / Loss Statement

- Run Rate Tracking

- General Ledger

- What If Scenarios

- Version control

- Multi-Department

- Multi Company

- Cash Management

Prophix Software Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by Personal Capital Corporation

Personal Capital is a budgeting software for businesses that helps keep spending in check. The software ensures that your transactional decisions are aligned with your financial goals by tracking and organizing spending and savings. On top of that, Personal Capital lets businesses create various customizable groups for managing transactions. Learn more about Personal Capital

Explore various Personal Capital features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Personal Capital Features- Dashboard

- Application Security

- Budget Management

- Retirement Planning

- Education Planner

Personal Capital Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Portfolio Management Solution

MProfit is India’s leading budget management software that helps you effectively manage your financial assets. It offers total portfolio management solutions for managing and tracking multiple asset classes like stocks, F&O, Mutual Funds, Traded Bonds, Fixed Deposits, NPS, PMS, AIF, etc. MProfits also offers in-depth analysis and performance insights. Read MProfit Reviews

Explore various MProfit features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all MProfit Features- Tax Management

- Portfolio Management

- For Investment Advisors

- Asset Management

- For Investors

- Asset Allocation

- For Investors & Traders

Pricing

MProfit Free

$ 0

Free to get started

MProfit Lite

$ 33

Everything in Free, and...

MProfit Plus

$ 83

Everything in Lite, and...

MProfit Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

All-in-one work management software

Shape your financial future with Scoro, the best budgeting software. It is a great tool for planning and forecasting your resources with efficient work management. Scoro allows you to manage finances in multiple currencies and controls the visibility of sensitive information using roles and permission. The software keeps track of all your transactions, including sales, purchases, costs, profits, etc. Read Scoro Reviews

Explore various Scoro features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Scoro Features- Task Management

- Employee Management

- Workflows Management

- Order Management

- Training Management

- Equipment Management

- Financial Management

- Time & Expense Tracking

Pricing

Plus

$ 22

User/Month

Premium

$ 33

User/Month

Ultimate

$ 55

User/Month

Scoro Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Free GST invoicing software for small businesses

Zoho Invoice is a free cloud-based budget management software for small businesses. The software enables you to create professional invoices, schedule payment reminders, and keep track of all your spending. Moreover, helps you manage your finances hassle-free by providing a complete breakdown of your expenses in a pie-chart form. Read Zoho Invoice Reviews

Explore various Zoho Invoice features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Invoice Features- Recurring invoice

- Payment Handling

- PCI Compliance

- Project Management

- Real Time Currency Quotes

- Dunning Management

- Receipt Printing

- Expense Tracking

Pricing

Free

$ 0

Per Month

Zoho Invoice Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Easy Software Solutions

Sleek Bill is the corporate budgeting software every business needs to plan a budget. The software makes it easier to manage GST, invoices, and clients, and it can be used anytime, anywhere, so you can access your bills from any desktop, tablet, or laptop. Sleek Bill is built with the highest safety standards to keep your data safe. Read Sleek Bill Reviews

Explore various Sleek Bill features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sleek Bill Features- Billing & Invoicing

- Accounting

- Document Printing

- Inventory Management

- Vendor Management

- Quotation & Estimates

- Invoice

- Email Integration

Pricing

Premium + Inventory Yearly License

$ 44

Per Year

Sleek Bill Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Software by WingsInfo

Wings Accounting is a world-class enterprise budgeting software to run your business better. The software helps with financial accounting, inventory, and taxes, providing deep insights into your business. Wings Accounting also ensures full GST compliance of e-invoices, e-bills, and online/offline returns with GST laws and regulations. Read Wings Accounting Reviews

Explore various Wings Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Wings Accounting Features- Outstanding

- Production Management

- Invoice

- Product Database

- Time Tracking

- Payment Handling

- HR & Payroll

- Inventory Management

Wings Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Cloud Accounting Software Making Billing Painless

FreshBooks is a simple and easy-to-use software for invoicing, payments, accounting, time-tracking, and bookkeeping. This top budgeting software helps keep an eye on the bigger picture by providing reports and analytics that explain your profitability, cash flow health, spending, etc. FreshBooks is ideal for freelancers, self-employed professionals, and businesses of all sizes. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Invoice

- Online Banking Integration

- Expense Tracking

- Stock Management

- Invoice Processing

- Receipt Management

- Credit Bureau Reporting

- Bookkeeping

Pricing

Lite

$ 19

Per Month

Plus

$ 33

Per Month

Premium

$ 60

Per Month

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Cloud Based Accounting & Inventory Software

ZipBooks is the best business budgeting software for finance, accounting, and inventory management. This comprehensive cloud-based software helps smoothly manage and run business with its dynamic features, multi-user capabilities, integrated accounting, and more. ZipBooks is an ascendible solution that can easily adapt to your business needs. Read Zipbooks Reviews

Explore various Zipbooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zipbooks Features- Cash Management

- Invoices

- Billing & Invoicing

- EMI Calculator

- Loan Management

- Track Account

- Sales Orders

- Import & Export Data

Pricing

ZipBooks

$ 69

User/Year

Zipbooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

It is best budgeting software

EveryDollar is one of the best budgeting software, loaded with online tools like paycheck planning, expense tracking, custom budgeting, reporting, and more. It is the best financial planning software for gaining total control of your money flow. EveryDollar is simple to use and is perfect for businesses of all sizes. Learn more about EveryDollar

Explore various EveryDollar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all EveryDollar Features- Balance Sheet

- Capital Asset Planning

- Multi-Department

- Forecasting

- Income Statements

- Multi Company

- General Ledger

- Cash Management

EveryDollar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Software by Intuit Inc

Mint is the best budgeting planning software for wiser money management. This online budget planner notifies you before you exceed your spending limits and detects potential budget improvements. It also lets you create unlimited categories and provides recommendations to make wiggle room, helping you reach your goals faster. Read Mint Reviews

Explore various Mint features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Mint Features- Income Statements

- Consolidation / Roll-Up

- Run Rate Tracking

- Balance Sheet

- General Ledger

- Project Budgeting

- Profit / Loss Statement

- Forecasting

Mint Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

What is Budgeting Software?

Budgeting software helps in creating, managing, evaluating, and updating the budget of organizations or businesses. It estimates expenses, sets a guideline, and regulates payments.

Any manual process in business is highly vulnerable to human error. Budgeting is a highly data-driven process. The slightest inaccuracy, oversight, or error can render even the most elaborate budget strategy ineffective. Business budgeting software automates most repetitive tasks related to budgeting and forecasting to minimize human intervention and drastically reduce the scope of error.

Budget management software automatically issues reminders to users whenever they are required to make any data entries. They can also automatically import data from other accounting, ERP, and HRM applications. Not only does this save time, but it also ensures that the data remains uniform and consistent across all systems. Therefore, data is collected promptly with as little human intervention as possible.

Budgeting and forecasting activities generally require much collaboration and coordination among different individuals within the organization. This becomes especially cumbersome in a manual process. Budget management software can facilitate easy collaboration. The budgeting or the approval process can be standardized to organize the entire process and improve communication. They also come with budgeting tools that allow users to create hypothetical forecasts. They come equipped with features that allow users to factor in things often overlooked, such as inflation. Therefore, budgeting and forecasting solutions can help businesses prepare better for the future and make informed decisions as they formulate their budgets.

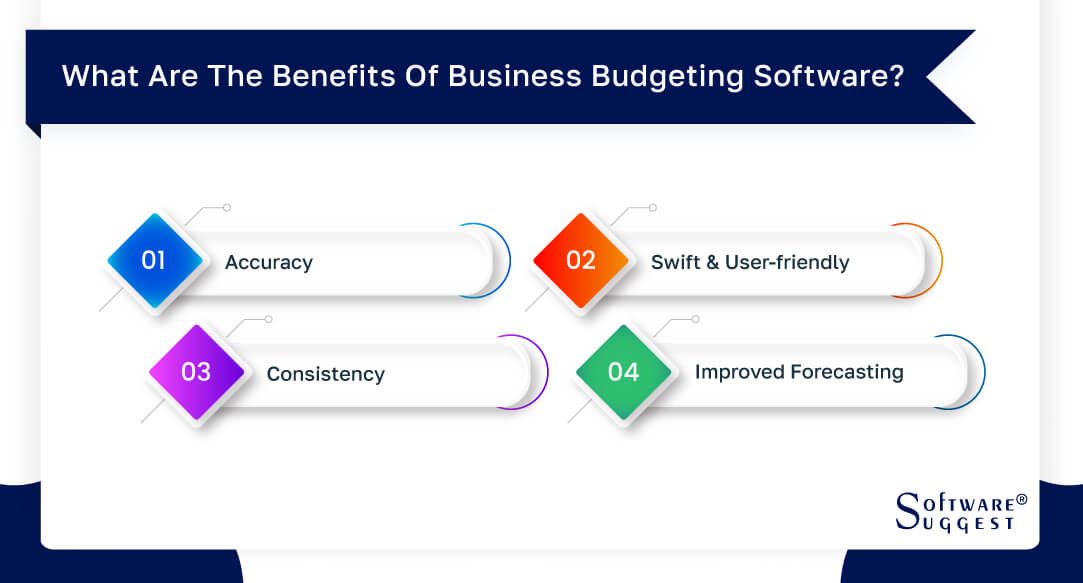

What are the Benefits of Business Budgeting Software?

There is a clear winner when it comes to manual and automated budgeting. Here are some of their benefits-

- Accuracy

Budgeting involves sensitive data and numbers and is an error-prone process. Errors can make the most strategic budget plans invalid. A reliable online budgeting tool or a money management app can automate most of the tasks so that minimal human effort is involved in the budgeting process, yielding accurate results.

-

Swift and User-friendly

When repetitive manual tasks are automated, resources are no longer required to spend hours and hours pouring over Excel sheets, consolidating them, and sharing them. Budget management apps enable users to retrieve historical data within minutes. They also enable users to manage and amend the budget easily without requiring a complete reworking. This saves much time and effort and simplifies the process.

-

Consistency

Online budgeting tools and money management apps store data in a consistent format irrespective of the source. They can import data from other systems, ensuring the data is uniform across all the platforms.

-

Improved Forecasting

Most budget management apps come equipped with superior forecasting capabilities. These programs can use complex algorithms, permutations, and combinations to sift through vast historical data for the most accurate results.

What to Consider When Choosing Budgeting Software?

Here are some things that you must consider when you want to choose the best budget software for your requirement

1. How user-friendly is the system? Can anyone use the system, or will you need skilled resources?

2. How smart is the forecasting system? Does it factor in things like inflation and other hypothetical scenarios?

3. How many users does the system allow? How does it facilitate collaboration? Does it allow collaborators to communicate with each other on the system itself?

4. How does the system enforce deadlines?

5. How compatible is the system with other finance, accounting, and HRM applications?

6. Will using the system saves costs in the long run? Is the price reasonable?

7. How does the system use past data?

8. What kind of reporting and analytics can be expected?

9. How secure is the system?

10. What kind of customer support is offered by the vendor?

The most important goal when running a business is to bring in revenue. It is easy to get caught up in the spending, however. There are office costs, marketing fees, and merchandise purchases. If you are not careful, you can spend more to run the business than you bring in from consumers. Human error accounts for a lot of mismanaged monetary assets. You may forget to add something to the list or allow an emergency. Budgeting software can help to keep you on track.

Of course, you must choose the right budgeting software for your business needs. This is something that can vary from one business and individual to another. There are various factors you need to consider when it comes to purchasing the right software, and taking the time to do this means you will be able to get the maximum benefit from the software you purchase or download.

When looking at different types of budgeting software for your business, one of the things you need to consider is the features and ease of use. The last thing you want is complicated and frustrating software, so look for something simple yet effective. Another thing you need to consider is the price of the software, as you need to ensure that the price fits in with your budget. You can also get free versions of budgeting software, although these are often more basic than the premium versions you pay for.

It is also well worth looking at reviews of the software you are considering for your business, as this will make it easier to determine whether you are making the right choice. You can look at consumer reviews online and make a more informed decision about the software you choose for your business. You can then be certain that you have the right product for your specific needs and benefit your business the most.

-

Tells you when to Quit

Budgeting software is a calculator tailored to your personal needs. You can set spending limits and set up notifications. You can be notified of the situation when the spending is at a certain amount. This allows business owners time to assess the situation before they exceed the allotted amount. Changes can be made to accommodate the spending trend each month. Those in charge can also halt spending privileges when something looks wrong. When you are aware of problems early on, there is a better chance of coming up with a viable solution.

-

Allows for Collaboration

One main reason a company budget goes awry is that too many people are involved with the assets. One department may purchase without consulting the other. There may not be room in the budget for two purchases. A large company can go into debt quickly if there is unauthorized spending. The people spending the money may never be in the same room or even in the same city. Budgeting software allows different users to log on and view the current budget state. They can also add the number of purchases into the system. This allows everyone to be aware of the budget situation.

-

Go Back in Time

Budget software is a great way to compare budgets over several years. You can look back at years when your spending was more in control and find out what was different. You can also look at years that resulted in debt to learn from your mistakes. It is also helpful to have a record of the budget for your business for each year. If you are ever audited, you can easily prove your spending habits. Patterns and increases in production costs can also be traced. When you spot a negative trend, your business can be saved from a financial disaster.

What Type of Business Needs Budgeting Software?

Budgeting is a sensitive activity, no matter what the scale. The exercise may not differ much across the industry. However, we can all agree that the priorities of one organization may not quite match the other. Therefore, their requirements for budgeting software may differ from each other. Here is how the size of the organization can inform one's decision when they are in the market for budget software:

-

Small Businesses

Small businesses would, first and foremost, require money management software that is easy to use. They may not have individuals skilled in finance and accounting to manage the activity. Small business budgeting tools must, therefore, be very user-friendly. While budgeting is important for small businesses, they may not require elaborate forecasting tools as they do not generally have much historical data.

-

Mid-Size Organizations

An area that most growing organizations struggle with is forecasting. Growing organizations are usually at a critical juncture where how they forecast can drastically impact their future. They cannot afford to overlook anything and must consider all the possible factors that may impact their future. They cannot afford to get carried away and make any overinvestment.

-

Large Organizations

Due to the sheer scale of operation, budget and forecasting become very complex activities in larger organizations. They tend to have multiple types of expenses and various sources of revenue. They have a huge number of employees and many departments. Therefore, they need money management software capable of handling such a huge operational scale.

Best Budgeting Software Tools to Manage Your Finances

-

You Need A Budget aka YNAB

You Need A Budget has developed a cult following in recent years and claims to have helped many users get out of debt. It has an easy-to-use and flexible system. What makes it work is a simple but effective philosophy: every dollar has to be accounted for. You give every dollar a job – from living expenses and investments to vacation and education. It allows you to sync your bank account or enter transactions manually.

Pricing: 34-day free trial; $83.99 annually; students get the first year free

Available on: Web, The App Store, Google Play, Windows

Pro Tip: The savings goals and debt payoff feature help you to attain true financial stability.

-

PocketGuard

Can’t keep yourself from overspending? This app can help. It does what its name suggests – guards you against splurging on things you don’t need with money you don’t have. PocketGuard links your financial accounts and tracks your spending throughout the month. You can set spending limits on each category. The app will notify you when you’re close to the limit, reminding you that you are committed to controlling your spending in that area.

Pricing: Free; Premium version (PocketGuard Plus) costs $3.99 per month or $34.99 annuallyAvailable on: App Store, Google Play

Pro Tip: PocketGuard tracks recurring expenses and helps you find better deals.

-

Personal Capital

Personal Capital has a greater focus on tracking and analyzing your investments. It analyzes your investment classes for free and lets you know which funds cost you the most. You link all your accounts on the app to get a complete overview of how each of your investments is doing. Its free money-tracking dashboard can be used to track other expenses as well. The optional paid features include expertized financial guidance, portfolio management, and financial planning. Even without the paid features, you can still do a lot with the app's free version.

Pricing: Free; the Price of paid services depends on your net worth

Available on: Web, The App Store, Google Play

Pro Tip: The Retirement Planner feature lets you plan and manage your retirement fund effectively. For free!

-

Splitwise

This one’s not a complete budgeting app, but it’s still handy. Splitwise is a nifty app that helps people track how much they owe to friends and colleagues and vice versa. It makes sharing expenses on outings, meals, events, etc, easy to track by logging in each transaction. It keeps a total over time so that you can pay back the money in a large payment rather than keeping track of every small amount or forgetting to pay it back. It also has email reminders for when a shared expense is due or when you must pay someone back. Neat, right?

Pricing: Free

Available on: The App Store and Google Play

Pro Tip: Splitwise has a ‘spinoff’ app, Plates, dedicated solely to splitting your restaurant bills!

-

TurboTax

An Intuit offering, TurboTax is a consumer-friendly tool for filing your taxes. It makes filling in the tax information easy, you can do it by importing your W-2 form information or just taking a picture of the form. For a short-term fix, a free version is a good option, especially if you only need to file your 1040A or 1040EZ.

The paid version, like Personal Capital, connects you with a CPA or other expert to help you maximize your returns.

Pricing: Free up to 5 returns; Paid plans start from $39.99 per return

Available on: The App Store, Google Play, Windows Store

Pro Tip: Get maximum deductions by staying updated on changing tax laws through the Tax Reform section on the TurboTax website.

-

Mint

Mint is a highly popular budgeting app. It takes your bank and credit card information to analyze your income and spending trends. It then points out the areas where you can spend less to improve your finances. You can set alerts for bills and upcoming payments to avoid unnecessary late fees. It also analyzes your credit score for free and gives you tips on how to improve it. You also get notified in case of unusually large spending or suspicious transactions.

Pricing: Free

Available on: The App Store and Google Play

Pro Tip: Track your spending trends over time and by the merchant to see where you spend the most.

-

Hopper

This last one is for the Globetrotters. Or for anyone who likes good deals on flights and hotels. It claims to have saved 30 million travelers $1.8 billion to date.

If you like to travel, but get stressed out at the thought of planning, from when to go to which flight to take, then Hopper is for you. It helps you to plan less and travel more. It predicts prices for hotels and flights with 95% accuracy, up to one year in advance. You can see the price predictions for each period of time and decide when the best time to make your trip. It will notify you automatically when booking your hotel or flight is the best time.

Pricing: Free

Available on: The App Store and Google PlayPro Tip: The Hopper website has a section dedicated entirely to travel tips, which can be useful when putting together that spur-of-the-moment trip.

By Countries

By Industries