Best Banking Software

Best banking software solutions are Finastra, Oracle FLEXCUBE, EBANQ, BankWare, Mambu, and CorePlus. These top core banking software companies help banking organizations digitize their routine operations and ensure their services are accessible remotely.

No Cost Personal Advisor

List of 20 Best Banking Software

Process-driven CRM for marketing, sales, service.

Creatio is the global supplier of no-code platform for industry workflows automation and CRM. Creatio’s customers enjoy the freedom to own their automation. Freedom is provided through unlimited customization, the ability to build apps without a line of code and a universe of ready-to-use templates and connectors. Read Creatio Reviews

Explore various Creatio features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Creatio Features- Customization

- Interaction Tracking

- Case Management

- Lead Scoring

- Plug-And-Play Integration

- Proposal Management

- Mass Email

- Sales Force Automation

Creatio Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Online Accounting Software for Growing Businesses

Zoho Books, one of the core banking software, is designed to be utilized by businesses of all sizes, including those that provide services, consult, and market, from small companies to large organizations. Users can work together in real-time online through the client portal that Zoho Books manages. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- General Ledger

- Online Accounting

- Import/Export Data

- Sales Management

- Monthly GST Report

- Quotation & Estimates

- Discount & Schemes

- Recurring invoice

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Sopra Steria Group

One of the best banking software companies, Sopra Steria, through its subsidiary Sopra Banking Software, offers a range of global solutions, including software, systems integration, support, and related consulting services. To meet the needs of financial institutions, Sopra Banking has an unparalleled capacity, which enables them to develop new services and increase the scope of the ones they already offer. Learn more about Sopra Steria

Explore various Sopra Steria features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sopra Steria Features- Customer DataBase

- Loan Processing

- Collections Management

- Business Loans

- Investor Management

Sopra Steria Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Temenos

In terms of providing community and retail banks, corporate, universal, private, and Islamic banks with banking software solutions, Temenos Group AG is the market leader. Temenos is convinced that working together is necessary to achieve growth and the best results for customers, especially when they are working in the banking industry. Learn more about Temenos

Explore various Temenos features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Temenos Features- Investment Banking

- ATM Management

- Securities Management

- Transaction Monitoring

- Multi-Branch

- Compliance Tracking

- Risk Management

- Retail Banking

Temenos Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

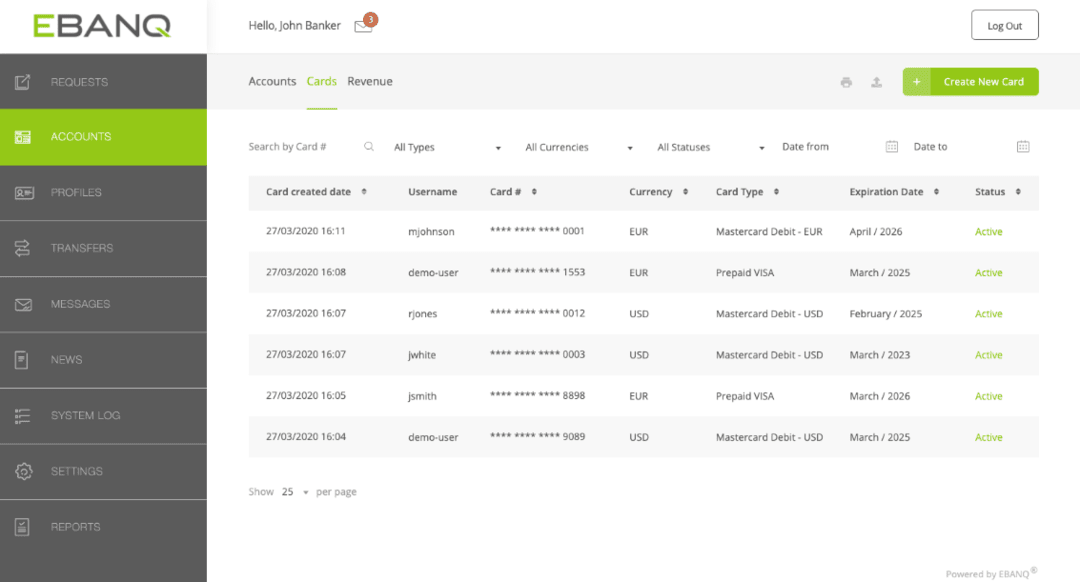

Turnkey white-label banking software

The most user-friendly white-label online best core banking software application available is referred to as EBANQ. It has the most important and customized modules, including e-banking, mobile apps for iOS, Android, and other platforms, SMS passcodes, and Swift Module. Read EBANQ Reviews

Explore various EBANQ features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all EBANQ Features- Online Banking Integration

- Loan Management

- Online Banking

- Investor Management

- Core Banking

- Multi-Branch

- Dashboard

- Balance Sheet

Pricing

EBANQ Core SaaS

$ 1000

Per Month

EBANQ Core Option A Hosted

$ 19000

One Time

EBANQ Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by International Financial Systems

Bankware is a cloud-based software with a range of versatile features to enhance operational efficiency. The BankWare Banking Software, the top banking software installation, consists of several parts that are specifically matched to your bank's business needs. These elements can be combined in any logical way, and more elements can be added at a later time without incurring any additional costs. Learn more about BankWare

Explore various BankWare features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all BankWare Features- Compliance Tracking

- For Banking

- Private Banking

- Retail Banking

- Multi-Branch

- Online Banking

- Transaction Approval

- Transaction Monitoring

BankWare Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Cloud platform for composable banking

Mambu, a software used in the banking industry, is a cloud-based platform that offers end-to-end financial services to enhance the client experience. Independent engines, systems, and connectors can be put together in any configuration to satisfy business needs and your customers' constantly shifting demands due to our innovative and ecologically friendly composable approach. Learn more about Mambu

Explore various Mambu features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Mambu Features- Marketing Automation

- Multi-Branch

- Transaction Monitoring

- Online Banking

- Chat / Messaging

- Retail Banking

- Private Banking

Mambu Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Avaloq

Avaloq Banking Suite provides a wide range of services like banking for retail customers, management of credit cards, cardsate banking, and securities management to customers in one location. The software used in banks for core banking, the Avaloq Banking Suite, has been created and offered by a company based in Swiss, namely Avaloq. Learn more about Avaloq Banking Suite

Explore various Avaloq Banking Suite features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Retail Banking

- Risk Management

- Compliance Tracking

- Credit Card Management

- Private Banking

- Transaction Monitoring

- Multi-Branch

- Online Banking

Avaloq Banking Suite Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

Software by EdgeVerve

Finacle is software for the banking industry with a broad feature set aimed at agencies and SMEs. Finacle offers comprehensive Windows-based solutions. Finacle is a cutting-edge, cloud-native online banking software that improves bank sales, customer engagement, and onboarding. Retail, SME, and corporate users can take advantage of its extensive capabilities and customized user interface. Read Finacle Reviews

Explore various Finacle features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Finacle Features- Compliance Tracking

- Investment Banking

- Securities Management

- Private Banking

- Transaction Monitoring

- Multi-Branch

- Online Banking

- Retail Banking

Finacle Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Digital Lending Software

Turnkey Lender is a quickly growing multinational firm that is focused on providing high-quality products for banks, financial institutions, and lending organizations of all sizes all over the world. This banking system software enables any complexity of the loan process to be digitalized for embedded, alternative, and traditional lenders. Learn more about TurnKey Lender

Explore various TurnKey Lender features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TurnKey Lender Features- What If Scenarios

- Forecasting

- Market Risk Management

- CRM and cross-channel integration

- Portfolio Management

- Live Prices

- P2P Payments

- Investigation Management

TurnKey Lender Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by BML Istisharat

To handle, manage, and oversee the front and back office operations of banks and financial institutions, BML Istisharat conceived, developed, and supported the Integrated Computerised Banking System, or ICBS. ICBS, among all the comprehensive Banking Software solutions, is one of the best software available for managing and controlling front and back office operations at banks and other financial institutions. Learn more about ICBS

Explore various ICBS features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all ICBS Features- ATM Management

- Compliance Tracking

- Online Banking

- Securities Management

- Risk Management

- Retail Banking

- Multi-Branch

- Private Banking

ICBS Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Apex Softwares

Apex Banking Software comprises an accounting system that satisfies all accounting and compliance reporting requirements and offers functional support for all of the financial institution's products and services. This software used in banks has a comprehensive approach to the integrated processing of all operations in a financial institution or Bank. Learn more about Apex Banking

Explore various Apex Banking features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Apex Banking Features- Retail Banking

- Multi-Branch

- Private Banking

- Online Banking

- ATM Management

- Transaction Monitoring

Apex Banking Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Co B I S

CoBIS, which is a core banking software, is a banking system that streamlines all workflow-related procedures. It is specially developed for microfinance institutions, village banks, MDIs, investment enterprises, and SACCOs. It assists in the management of accounting, customers, suppliers, and loan portfolios through financial planning, reports, and other tools. Learn more about CoBIS

Explore various CoBIS features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CoBIS Features- Private Banking

- Online Banking

- Multi-Branch

- Investment Banking

- Corporate Banking

- Retail Banking

- Risk Management

- Compliance Tracking

CoBIS Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Banksoft

A strategic tool for bankers, CoreBank is an integrative and flexible best core banking software. A modern, dynamic, and adaptable bank's concept and structure serve as the foundation for CoreBank, a technology. By providing a variety of account alternatives for private, personal, and business banking, Core Bank meets all of your specific needs. Learn more about CoreBank

Explore various CoreBank features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CoreBank Features- Private Banking

- Retail Banking

- Multi-Branch

- Online Banking

- Transaction Monitoring

- Corporate Banking

- Credit Card Management

- Risk Management

CoreBank Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by Nelito Systems

FinCraft CBS, among all the other banking software programs, is an enterprise banking solution that enables Banks to easily and dependably offer a comprehensive range of banking services and information to consumers with various user profiles. FinCraft CBS has retail banking as its primary module and can interact with a variety of delivery channels, including i-banking, ATMs, etc. Learn more about FinCraft

Explore various FinCraft features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FinCraft Features- Risk Management

- Compliance Tracking

- Securities Management

- Multi-Branch

- ATM Management

- Transaction Monitoring

- Retail Banking

- Online Banking

FinCraft Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

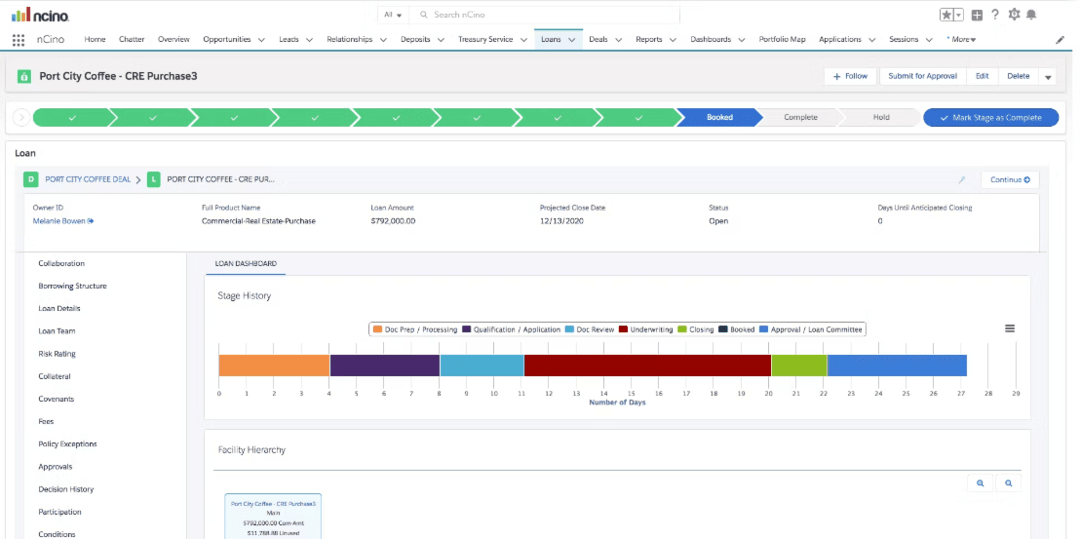

Software by nCino

nCino, a well-known software used in banks, is developed by the fintech company named nCino, which is headquartered in North Carolina. It helps in gaining efficiency in the banks and financial institutions by digitizing and streamlining the processes for almost all types of banks of all sizes in all areas. Learn more about nCino

Explore various nCino features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all nCino Features- Multi-Branch

- Fee Management

- Corporate Banking

- Digital Signature

- Retail Banking

- Online Application

- Online Banking

- Risk Management

nCino Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Software by SecurePaymentz

SecurePaymentz is the banking software designed for businesses and financial institutions to obtain a mini bank to simplify financial dealings with clients, including payment processing, use of the magnetic card system, and more. This system is ideal for companies that want to manage user accounts, Mobile Banking, affiliate systems, multi-level businesses, and systems similar to banks or financial institutions. Learn more about SecurePaymentz

Explore various SecurePaymentz features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SecurePaymentz Features- Credit Card Management

- Transaction Monitoring

- Securities Management

- Corporate Banking

- Online Banking

- Private Banking

SecurePaymentz Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Reliable internet banking online software

With Corniche, Banks and financial institutions can self-manage the sales cycle from the time they first agree to carry out a transaction through to delivery and payment. By using this software used in the banking industry, currency positions during FX swings are automatically accounted for by a general ledger with numerous currencies. Learn more about CornicheNet

Explore various CornicheNet features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all CornicheNet Features- Transaction Monitoring

- Online Banking

- Private Banking

- Compliance Tracking

- Investment Banking

- Retail Banking

- Multi-Branch

CornicheNet Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

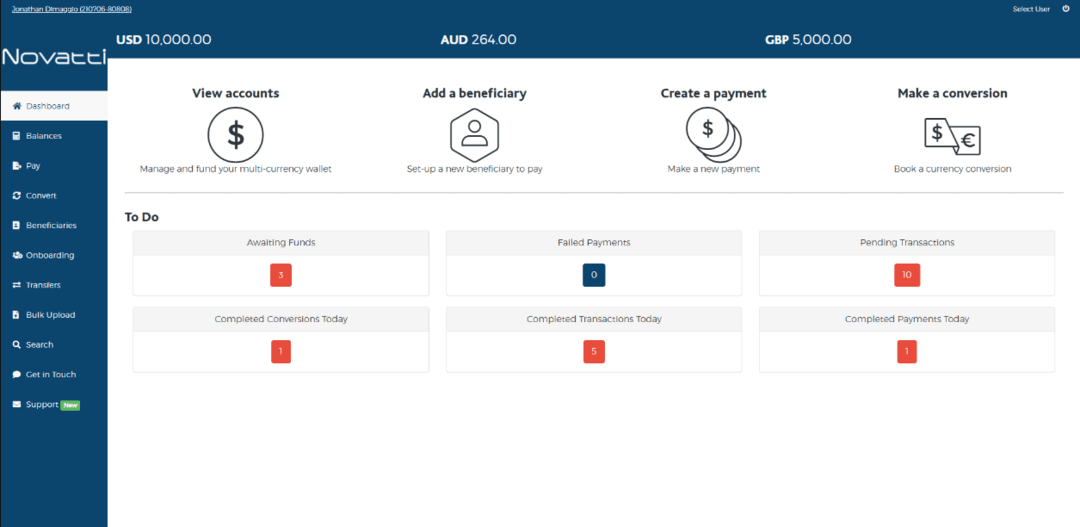

Software by Novatti

Novatti mobile banking system software enables banks to provide cardless banking and on-the-go bill payments. Any organization that is working to increase financial inclusion in the area should be targeted. Telcos, banks, and FinTech companies are frequently among them. Payment services are also available for Australian e-commerce and commercial payments with this Banking Software. Learn more about Novatti

Explore various Novatti features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Novatti Features- Bill Payment

- P2P Payments

- Cash Management

- Digital Wallet

Novatti Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Power of Simplicity

TallyPrime is one of the top banking software available worldwide and has sophisticated accounting, stock control, reporting, and payroll functions. It is economical for small and medium businesses to use TallyPrime since you don't have to pay an extra amount of money for new features. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Voucher Management

- HR & Payroll

- GST

- Sales Management

- Budgeting

- Customer Management

- Supplier and Purchase Order Management

- GST Ready

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Do you know that there are premier banking software solutions available in the current market? In today's swiftly evolving financial landscape, where seamless operations and exceptional client experiences hold immense significance, the selection of suitable banking software has reached a heightened level of importance. Irrespective of your affiliation with a traditional bank, credit union, or thriving fintech venture, the selection of bankruptcy software is important. It should align with your institution's unique needs and can significantly impact your outcomes.

This guide takes a thorough dive into a carefully selected range of alternatives in the world of banking software companies. It covers a variety of aspects, including use cases for banking software used within financial institutions and solutions tailored to the banking sector. The guide will closely evaluate prominent options offered by respected companies, critically analyzing their features, capabilities, scalability, and overall value.

What Is a Banking Software?

Banking software pertains to specialized applications and software programs crafted to aid diverse financial functions within the banking sector. This encompasses an array of digital instruments that optimize duties like processing transactions, overseeing accounts, managing client engagements, and ensuring adherence to regulations. These banking system software are meticulously crafted to elevate effectiveness, precision, and the overall customer journey within banking activities.

From core banking systems that manage fundamental transactions to customer relationship management (CRM) platforms that foster better communication, corporate banking software plays a pivotal role in modernizing and optimizing financial institutions. The banking software solutions ensure smoother internal processes and support data-driven decision-making. Also, the debt collection system enables banks to adapt to evolving industry standards and customer expectations in an increasingly digital landscape.

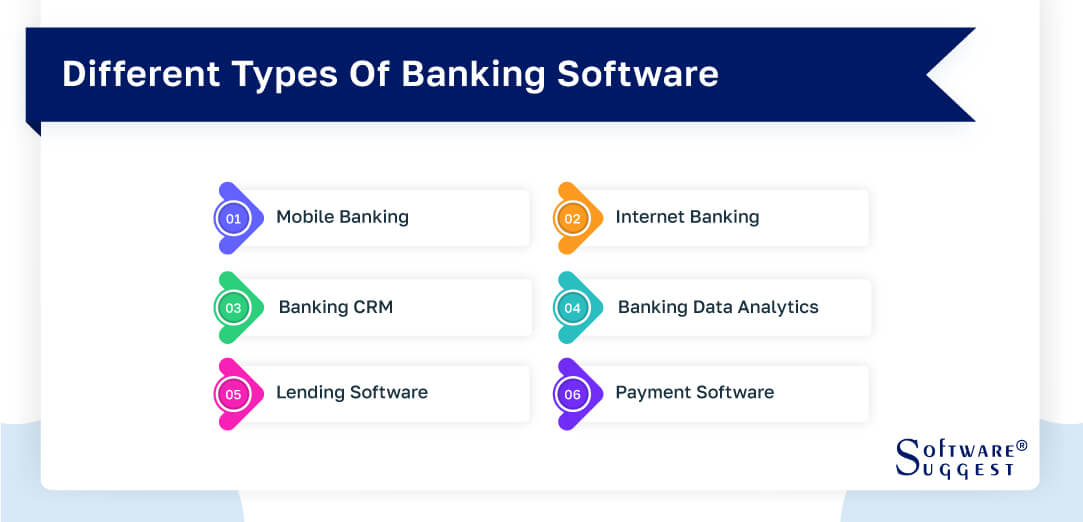

Different Kinds of Banking Software

-

Mobile Banking

Banking software for mobiles helps provide customized solutions to specific needs. Most software solutions vary; some provide basic functionality while others provide top-of-the-class functions. A few examples are loyalty program integration, personalized banking, augmented reality, etc.

-

Internet Banking

Internet banking software has made banking much simpler and faster than before. The solutions the bank provides help clients enjoy a smooth banking experience. Apart from that, it also helps banks get detailed information about the various savings and credit accounts. The software even sets limits on customers’ cards, transfers money between accounts, requests bank statements, etc.

-

Banking CRM

Banking CRM enhances the generation of customers’ data and effectively communicates with current and prospective customers. Banking CRM helps in boosting the bank’s effectiveness in various activities that are customer-related. It manages cross-selling, channel activity tracking, customer support, etc.

-

Banking data analytics

Banking software also happens to include banking data analytics. The different data analytics include channel analytics, marketing analytics, risk analytics, customer analytics, etc.

-

Lending Software

This particular software assists in making fast and well-informed loan decisions. It also reduces the time and cost of delivery of loans. Loan origination, servicing and underwriting are digitized. It also creates a single system that records all the lending operations.

-

Payment Software

This harnesses the power of digital payment. Fast and secure transactions are ensured along with mobile payment solutions. Customers are allowed to make real-time payments and well as payments between person-to-person.

Apart from these, numerous other banking software are knowledge management solution, document management system, bank intranet, etc.

Benefits of the Best Banking Software

In the dynamic world of finance, harnessing the power of the best banking software is imperative for institutions seeking to excel. This section navigates through the profound benefits offered by top-tier banking software providers, unveiling a spectrum of benefits that extend from security enhancements to superior customer experiences.

-

Enhanced security

In an era marked by cyber vulnerabilities, the paramount significance of fortified security cannot be overstated. Top banking software companies take the helm in this world, leveraging robust encryption, multi-factor authentication, and vigilant real-time monitoring.

These layers of defense bolster institutions against the ever-evolving spectrum of cyber threats, fostering an environment of trust among clients. This, in turn, solidifies the institution's commitment to upholding stringent regulatory compliance, assuring stakeholders that sensitive data remains shielded against breaches and unauthorized access.

-

Efficient transaction processing

Efficiency is the cornerstone of seamless financial operations. Top banking software shoulders the responsibility of orchestrating intricate financial tasks with finesse and expediting processes like fund transfers, payments, and settlements.

This heightened speed doesn't merely elevate customer satisfaction but also bears tangible benefits for the institution itself. By minimizing processing times, operational costs are curtailed, contributing to the institution's fiscal prudence and competitiveness in the industry.

-

Mobile and online banking capabilities

The digital age mandates a seamless transition into mobile and online banking services. Premium software used in banking industry emerges as the enabler, furnishing institutions with platforms that seamlessly encapsulate the essence of financial management in the palm of a customer's hand.

This uninterrupted accessibility transcends spatial constraints, empowering customers to manage their finances on the go. Beyond convenience, this augmentation of banking capabilities fuels customer engagement and loyalty, cementing the institution's position as a modern and responsive financial partner.

-

Competitive advantage

In a landscape defined by relentless competition, deploying cutting-edge banking transformation software stands as a game-changer. By streamlining operations and optimizing resource utilization, institutions harness the potential to introduce innovative financial products and services.

This adaptability lends itself to a heightened competitive edge, positioning the institution as a pioneer in a market teeming with contenders. The agility afforded by such software translates to the swift launch of solutions that resonate with evolving customer needs, thereby augmenting market presence and stimulating growth.

-

Better customer experience

Customer-centricity constitutes the nucleus of banking success. Leading banking CRM software takes the mantle of empowering institutions with the tools to not only understand customer behavior but to tailor offerings accordingly. This customization fosters a profound connection, as customers feel understood and catered to on an individual level.

Such an elevated experience becomes a conduit for forging enduring relationships and cultivating customer loyalty that extends beyond the transactional realm, positioning the institution as a trusted financial partner.

-

Fraud detection & prevention

In a landscape fraught with rising cyber threats, a proactive stance against fraud becomes paramount. Advanced banking investment management systems leverage the prowess of AI-driven algorithms to meticulously scrutinize transactions. This vigilant analysis detects anomalies, flags potential threats, and acts swiftly to prevent fraud in real time.

This potent combination of technology and vigilance safeguards both the institution and its valued clientele from the perils of financial malfeasance. With such a robust fraud prevention mechanism in place, stakeholders can rest assured that their assets remain shielded in the digital domain.

Features Of The Best Banking Software

In the constantly changing world of banking, the search for better technical solutions has ushered in a new era. Let's carefully examine the essential components of the best banking or revenue management system, which will disclose a wide range of features that jointly redefine the boundaries of contemporary banking operations.

-

Customizable interfaces

In the world of optimal financial service providers, the provision of customizable interfaces signifies a commitment to inclusivity. This versatility extends across customer-facing platforms and internal dashboards, empowering institutions to curate a seamless digital journey aligned with their unique branding and user requisites.

Such personalization not only elevates user engagement but also solidifies the institution's distinct presence in the digital arena, thereby fostering a harmonious connection between the software and the institution's overarching identity.

-

Core banking functions

Central to exemplary banking software resides a formidable core banking module. This module drives important tasks like managing accounts, processing transactions, and keeping detailed records. By orchestrating the convergence of diverse operational facets, this module ensures precision, efficiency, and regulatory adherence.

Its role as the foundational bedrock of an institution's financial activities is indisputable, upholding the integrity of financial transactions and facilitating the seamless orchestration of multifaceted processes.

-

ATM management

Efficiently overseeing automated teller machines is a crucial aspect of exceptional financial software solutions. This trait empowers institutions with the capability to remotely oversee, control, and enhance ATM operations.

This functionality, encompassing cash administration, transaction surveillance, and issue resolution, plays a role in heightening service dependability, lessening periods of inactivity, and refining maintenance procedures by amalgamating these tasks. Thus, the introduction of real-time monitoring and remote administration enhances both user convenience and operational efficiency.

-

Live customer support

Amidst the digital revolution, the irreplaceable human touch persists. Exceptional banking software integrates live customer support features, endowing customers with the ability to instantaneously connect with representatives.

This personalized aid promptly addresses queries, cultivates customer confidence, and provides an immediate channel for query resolution and guidance. The fusion of technological prowess and human interaction exemplifies a commitment to a holistic and responsive banking experience.

-

Real-time transaction processing

In an era characterized by immediacy, real-time transaction processing stands as a quintessential facet of superior banking software. This capability ensures the instantaneous execution of financial transactions, whether initiated by customers or institutions.

This seamless rapidity not only augments user contentment but also contributes to financial precision and operational seamlessness, minimizing discrepancies and obviating the latency associated with traditional transaction processing methods.

-

Mobile payments and contactless solutions

By synchronizing with the prevailing mobile-centric landscape, distinguished banking software seamlessly integrates mobile payments and contactless solutions. This functionality empowers customers to conduct transactions through mobile devices and contactless payment modes. This innovation bestows heightened convenience, enabling users to effortlessly navigate financial interactions while fostering an environment of secure and efficient monetary engagements.

-

Data management and history tracking

The meticulous management of data assumes paramount importance within banking operations. Pioneering banking loan management system offers all-encompassing tools for the systematic organization and tracking of transactional data.

This functionality not only ensures the transparency of financial undertakings but also endows institutions with insights derived from historical data. These insights prove instrumental in strategic decision-making, compliance endeavors, and the identification of patterns that can inform future financial strategies.

-

Integrated customer relationship management (CRM)

Elevating customer relationships to an art form, the integration of CRM features distinguishes remarkable banking software. This module amalgamates customer data, interactions, and feedback, facilitating a comprehensive understanding of individual clientele.

Armed with this panoramic insight, institutions can tailor services, cultivate engagement, and forge personalized strategies. These strategies contribute to the augmentation of customer satisfaction, loyalty, and the establishment of an enduring rapport between the institution and its valued patrons.

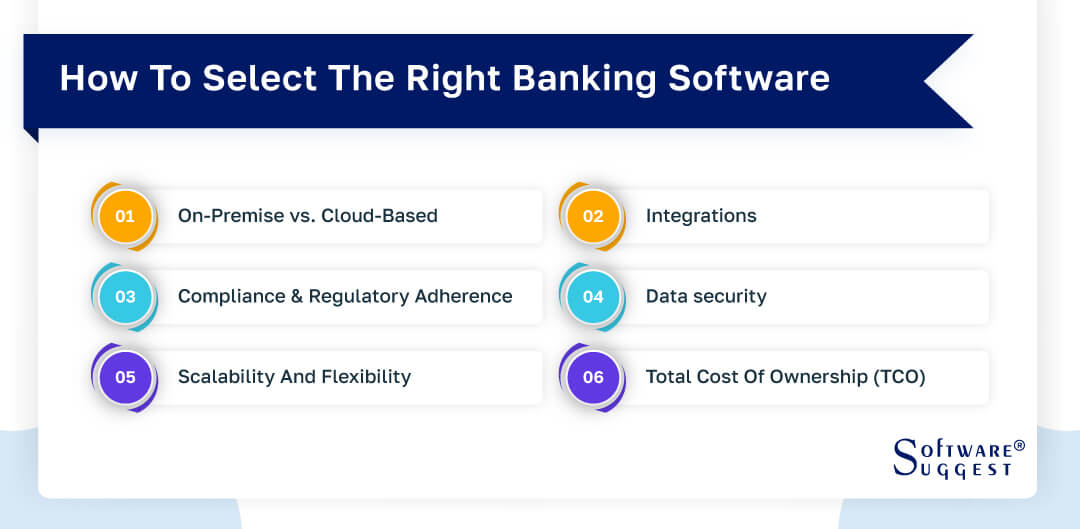

Things To Consider When Selecting The Right Banking Software

In the realm of modern banking, selecting the right banking software is akin to choosing the perfect partner for a successful financial journey. With a multitude of options available, making an informed decision requires careful consideration of several critical factors. Let's dive into these key considerations, shedding light on the aspects that deserve attention when choosing the optimal banking software solution.

-

On-premise vs. cloud-based

As you embark on your software selection journey, the first significant decision lies in choosing between on-premise and cloud-based solutions. On-premise software takes residence within your institution's infrastructure, granting full control but necessitating more maintenance. On the flip side, cloud-based solutions offer flexibility and scalability by hosting your software remotely. Your choice here profoundly influences your software's accessibility, upkeep demands, and potential to accommodate your institution's growth trajectory.

-

Integrations

Imagine your banking software as a symphony orchestra, where every instrument must harmonize seamlessly. The ability to integrate flawlessly with other systems is pivotal. Consider its compatibility with existing tools like CRM, accounting, and payment systems. A harmonious integration saves time, minimizes errors, and amplifies overall operational efficiency. Just as a symphony achieves its brilliance through harmony, your software's integration capabilities contribute to a smoother, more efficient banking performance.

-

Compliance and regulatory adherence

In the intricate dance of banking operations, navigating the regulatory landscape is akin to a choreographed routine. The right software must be in sync with ever-evolving regulations and compliance demands. It should readily adapt to changes, generating the requisite reports and documentation to pass audits. This compliance-focused software not only mitigates risks but also underscores your institution's dedication to ethical and legal standards, ensuring your financial choreography adheres to the right steps.

-

Data security

In this day and age, the protection of private financial information is analogous to the fortification of a treasure vault. Banking loan origination tools that come packed with strong encryption, multiple factors of authentication, and tight access controls should be given priority. The data of both your organization and your customers are protected from potential cyberattacks as well as unlawful access by this protective outfit. Just as you'd fortify a vault to protect valuable assets, this software offers digital peace of mind for your organization and its clients.

-

Scalability and flexibility

Your software should expand and adapt in tandem with the development of your organization, just as an expanding family needs more room to accommodate their needs. Choose a system that can effortlessly support your growth as your business does. The capacity of such software to accept increased transaction volumes, adapt to changing client requirements, and integrate new features in a seamless manner is one of its defining characteristics. Because of its adaptability, your software will be able to fit the trip that your institution takes as it develops through time.

-

Total cost of ownership (TCO)

When selecting banking software, the initial price tag isn't the sole consideration. It's like evaluating the overall expense of owning a home, including maintenance and improvements. Assess the total cost of ownership across the software's lifecycle, encompassing implementation, maintenance, upgrades, and potential customization. Delve beyond financial costs, considering the time and resources your institution needs to invest. A comprehensive assessment ensures your chosen software aligns harmoniously with your institution's financial roadmap.

Top 5 Banking Software Comparison

|

Name

|

Free Trial

|

Demo

|

Pricing

|

|---|---|---|---|

|

14 Days |

Yes |

Custom Pricing |

|

|

30 Days |

Yes |

Custom Pricing |

|

|

14 Days |

Yes |

Custom Pricing |

|

|

14 Days |

Yes |

Custom Pricing |

|

|

14 Days |

Yes |

Starting price at $ 3.60 up to 25 no.of deductee |

Now, we will go through a comprehensive comparison of the top 5 banking software. Evaluating their features, capabilities, and performance, we aim to provide you with valuable insights to make an informed decision for your institution's digital transformation. Let's look at them in detail:

1. Ebanq

EBANQ stands as a robust software solution crafted for financial institutions and banks. Its repertoire encompasses an array of functions: account oversight, transaction processing, card issuance, and beyond. User-centric interface melds with stringent security, fostering both user and administrator confidence. EBANQ caters adeptly, regardless of being a compact credit union or a sprawling global bank, equipping with operational efficiencies and elevated client service standards.

- Multiple administrator accounts

- SMS passcodes (OTP)

- Intercom chat widget

- Batch import transfer requests (OWT)

- Swift/BIC module

- Versatile currency management

- Ebanq Core offers a user-friendly interface that makes it easy for both administrators and customers to navigate

- It allows banks to customize their online banking platform to reflect their brand identity, and this enhances the overall user experience by providing a personalized touch

- The platform prioritizes the security of its users' data by implementing robust security measures

- It offers a wide range of features that cater to various banking needs

- The platform is designed to accommodate the growth of a bank's customer base

- Implementing Ebanq may come with a high upfront cost, especially for smaller banks or financial institutions with limited budgets

- Setting up and maintaining Ebanq Core may require technical expertise, and it means that banks would need to allocate resources and potentially hire IT professionals with specialized knowledge to ensure the platform runs smoothly

- Integrating Ebanq Core with existing banking systems and processes may pose challenges

- While Ebanq Core offers customization options, there may be certain limitations in terms of design and functionality

Pricing

- Custom pricing.

2. Mambu

Mambu presents a potent, adaptable cloud-based banking platform catering to financial institutions. Its intuitive interface empowers banks to optimize operations and enrich customer interactions.

Mambu's software facilitates integration, scalability, and real-time analytics across processes like loan origination and account management. By leveraging cloud capabilities, financial entities achieve agility, cost-efficiency, and swift digital evolution. Mambu drives a transformative shift in banking software, leading toward an efficiency-focused and customer-centered future.

- Personal lending

- Buy now pay later

- Purchase finance

- Embedded finance

- Banking-as-a-service

- Mambu offers a scalable solution that can grow with your business, so no matter if you are a small startup or a large enterprise, its cloud-based platform allows you to easily scale your operations without the need for extensive infrastructure investments

- The platform provides a highly flexible platform that can be customized to suit your specific business needs

- Mambu enables quick and efficient time to market for new financial products and services

- It seamlessly integrates with a variety of third-party systems and applications, making it easier to connect with other tools in your tech stack

- Mambu is designed to support financial institutions operating globally.

- While Mambu offers a powerful platform, it may have a learning curve for users who are new to the system

- While Mambu provides flexibility, there may be limitations when it comes to extensive customization

- Implementing and maintaining a Mambu platform may entail significant costs, especially for smaller businesses with limited budgets

Pricing

- Custom pricing.

3. nCino

nCino is revolutionizing the banking sector. Their software helps financial institutions operate more effectively by streamlining procedures and fostering collaboration. The establishment from nCino offers smooth relationship management, loan origination, and onboarding with a focus on the needs of the consumer. Additionally, it offers real-time analytics and insights, enabling banks to make data-driven choices.

While providing a user-friendly experience for both bankers and consumers, nCino's cutting-edge technology maintains regulatory compliance and security. Utilize cutting-edge software from nCino to experience the banking of the future.

- Loan origination

- Account opening

- Portfolio analytics

- Document management

- End-to-end client journey

- The nCino platform offers a comprehensive suite of tools and features that can help streamline operations for businesses

- With nCino, businesses can provide their customers with a seamless and personalized experience

- It offers robust risk management capabilities, allowing businesses to assess and mitigate risks more effectively

- nCino's platform promotes collaboration among teams and departments within an organization

- The nCino platform is designed to scale with businesses as they grow, and it offers flexibility in terms of customization and integration with existing systems

- Implementing and maintaining the nCino platform can be costly, especially for small businesses

- Adopting a new platform like nCino can involve a learning curve for employees

- As nCino is a cloud-based platform, businesses using it are dependent on stable and reliable internet connectivity

- While nCino offers customization options, there may be limitations in terms of tailoring the platform to specific business needs

Pricing

- Custom pricing.

4. Novatti

Novatti stands as a pioneering firm delivering inventive answers for digital payments and financial functions. Their software crafts smooth transactions, bolsters security, and ensures an uninterrupted user journey. Concentrating on burgeoning markets, Novatti equips enterprises and individuals to effortlessly execute payments, oversee finances, and access financial offerings. Their forefront technology and unwavering devotion to user contentment establish Novatti as a prominent contender within the software sector.

- Card issuing

- Payments technology

- Payment management

- Cross border transaction

- Subscription billing

- Novatti offers a wide range of payment solutions, including mobile wallets, prepaid cards, and digital banking, making it easier for businesses and individuals to manage their finances efficiently

- It operates on a global scale, providing its services across multiple countries, which allows businesses to expand their operations and reach new markets seamlessly

- Novatti prioritizes security, implementing advanced encryption and fraud detection systems to protect sensitive financial information

- The platform offers customizable solutions that can be tailored to meet the specific needs of businesses

- Novatti continuously invests in developing and adopting new technologies, staying at the forefront of the payment industry

- Although Novatti provides a range of payment solutions, some users may find the available options limited compared to other competitors in the market

- Novatti's advanced features and functionalities might require a learning curve for users who are not familiar with their platform

- Its pricing structure may not be suitable for all businesses, especially smaller enterprises or startups with limited budgets

- While Novatti strives to provide excellent customer support, some users may experience delays or difficulties in receiving timely assistance

Pricing

- Custom pricing.

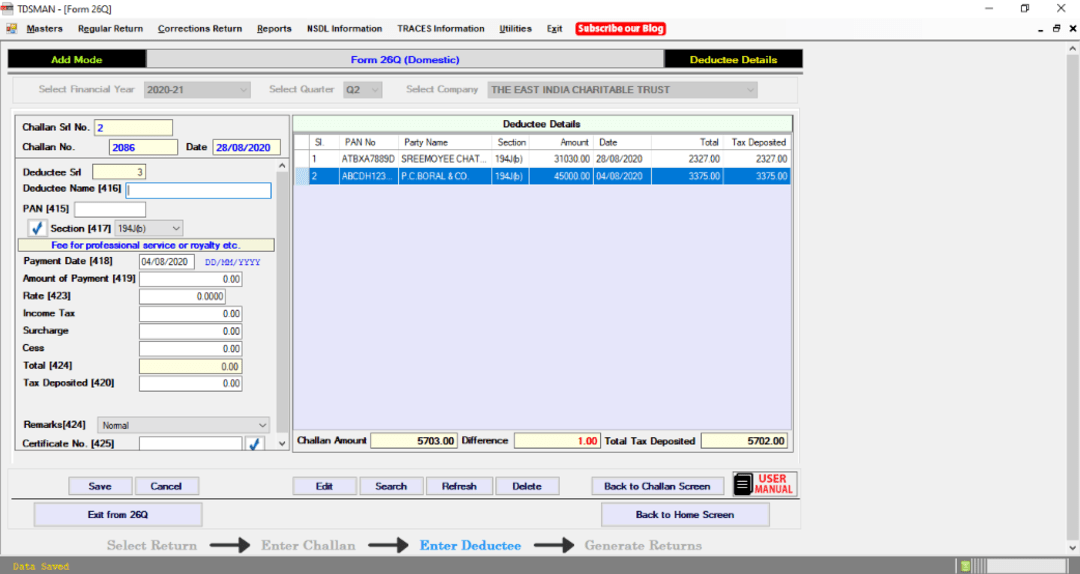

5. TDSMAN

TDSMAN Online serves as an all-encompassing solution crafted to facilitate the management of tax deducted at source (TDS) in India. Its interface ensures ease of use, coupled with advanced attributes that cater to both individuals and entities. The software enables the generation of TDS returns, preparation of correction statements, and seamless e-filing. Real-time updates and notifications are embedded to guarantee alignment with prevailing tax norms. TDSMAN Online emerges as a dependable and effective resolution for diverse TDS requisites.

- Import / export data from Excel

- Automatic data validation & FVU generation in one click

- Auto download of CSI file

- Auto tax calculation

- TDS calculator for salary

- The website has a clean and intuitive design, making it easy for users to navigate and find the information they need

- TDSMAN Online offers a wide range of services related to tax deduction at source (TDS) compliance

- The website provides automated features such as bulk PAN verification, import/export of data, and auto-correction of TAN and PAN, which help users save time and reduce manual errors in their TDS compliance processes

- It offers a detailed knowledge base, FAQs, and video tutorials to guide users through the TDS compliance process

- The website employs robust security measures to protect user data and ensure the confidentiality of sensitive information

- The website primarily focuses on TDS compliance services, which may limit its usefulness for users who require assistance with other tax-related matters

- While the website functions well on desktops and laptops, it may not be fully optimized for mobile devices, potentially leading to a less-than-optimal user experience for users accessing the site on their smartphones or tablets

- The website does not prominently feature customer reviews or testimonials, making it difficult for potential users to gauge the experiences and satisfaction levels of existing customers

Pricing

The pricing starts from:

- TDS returns- $ 3.60 up to 25 no. of deductee

- TDS collection- $ 4.80 up to 50 no. of correction in deductee records

- TDS package- $12.02

Market Trends In Banking Software Solutions

The field of banking has experienced notable transformations in the past few years, primarily due to advancements in technology and changes in what customers expect. As a result, new trends in banking software solutions have arisen. In the following paragraphs, we will delve into several crucial market trends that are molding the direction of banking software in the coming years. Let's see them closely:

-

Communication channels

One of the notable market trends in banking software solutions is the adoption of various communication channels. Traditional methods of communication, such as phone calls and branch visits, are being supplemented and sometimes even replaced by digital channels. Banks are now offering customer support through online chatbots, social media platforms, and mobile apps. This shift towards digital communication enables banks to provide faster and more convenient services to their customers, enhancing the overall customer experience.

-

Digital transformation

The concept of going digital has gained significant attention within the banking sector, and understandably so. Financial institutions are adopting technological solutions to make their processes more efficient and effective. This encompasses the conversion of diverse banking activities, like initiating accounts, processing loans, and conducting transactions, into digital formats.

Additionally, banks are dedicating resources to establishing strong digital frameworks that ensure smooth and consistent interaction for users across various platforms. By embracing the digital shift, banks can enhance their adaptability, minimize expenses, and more effectively address the changing preferences of their clientele.

-

Artificial intelligence and machine learning

The dynamic duo of Artificial Intelligence (AI) and Machine Learning (ML) are causing a transformative wave in the world of banking. These innovations empower financial institutions to scrutinize extensive data, recognize trends, and formulate precise forecasts. Chatbots infused with AI capabilities offer individualized guidance and support to patrons, whereas ML algorithms pinpoint deceitful transactions and curtail hazards.

Beyond this, AI and ML possess the capability to mechanize ordinary chores, allowing human assets to be channeled into more intricate and value-enhancing undertakings. With the continued evolution of AI and ML, their influence on solutions for banking software is poised to only become more formidable.

-

Software development

The landscape of software evolution remains in constant flux, and the banking sector is an active participant in this evolution. Financial institutions are progressively embracing agile development approaches to hasten the rollout of fresh attributes and features. This empowers banks to promptly address shifts in the market and the expectations of their clientele.

Furthermore, banks are harnessing the potential of cloud computing to curtail expenses tied to infrastructure and to facilitate the efficient expansion of their software solutions. As the methods of software development continue to progress, banking software is poised to gain strength, versatility, and the capacity to seamlessly conform to dynamic business prerequisites.

-

Open banking and APIs

Open banking is a concept that promotes the use of open APIs (Application Programming Interfaces) to enable third-party developers to access bank data securely. This trend is revolutionizing the banking industry by fostering innovation and competition. With open banking, customers can securely share their financial data with authorized third-party applications, enabling personalized financial services and products. This trend is driving the development of banking software solutions that are interoperable and capable of integrating with external systems, opening up new possibilities for collaboration and value creation.

-

Decentralized finance (DeFi)

Decentralized finance, sometimes known as DeFi for short, is an innovative approach to managing one's financial affairs that makes use of an innovative technology known as blockchain. People are now able to conduct business with one another directly, bypassing banking establishments and other intermediaries. This has the potential to alter the conventional method of banking by making processes like the transfer of funds more transparent, expedient, and equitable. As the use of DeFi grows in popularity, the computer programs that banks already employ may need to be updated.

What Is The Average Cost of Banking Software?

The price of banking software can change a lot based on different things. These things are how big and hard the bank is, what things and abilities the software needs, and who makes the software. For tiny local banks or credit unions, the cost of banking software can be from thousands to a few hundred thousand dollars. This usually covers basic banking things like handling accounts, doing transactions, and making reports.

The cost of banking establishment software can differ a lot based on the kind of software and the company making it. The starting cost of banking software can range from $2,500 per month to a one-time payment of $200,000. Systems that handle basic banking tasks like handling deposits, loans, and credits can be about $100 million for a normal-sized bank.

But remember, the price can change based on how big and what kind of bank it is and what the software has to do. It's a good idea to compare different banking software options and companies to find what suits your organization's needs and budget the best.

Conclusion

In conclusion, finding the best banking software requires a thorough understanding of your institution's specific needs, technological infrastructure, and long-term goals. By now, you've explored this buyer guide with a range of essential factors to consider when evaluating options. Prioritizing security features, scalability, user-friendliness, integration capabilities, and customer support ensures that the chosen banking software aligns with your organization's requirements.

As the banking industry continues to evolve, the right software solution will empower your institution to stay competitive and responsive to changing market demands. With a well-researched approach and a focus on long-term value, your organization can embark on a transformative journey toward optimal digitalization and success in the modern financial landscape.

FAQs

AI enhances banking software's customer experience through personalized services, including AI-powered chatbots for instant support, tailored product recommendations from transaction history, real-time fraud detection, and predictive analytics for proactive advice.

Mobile banking software adopts biometric authentication for secure access, blockchain for transparent transactions, machine learning for user behavior analysis, IoT integration for convenience, and voice recognition for hands-free interactions.

The best banking software streamlines operations via automation, ensures security with encryption and authentication, boosts customer satisfaction through seamless experiences, accommodates integration and scalability needs, and assists compliance with regulations like AML and KYC.

By Countries

By Cities

.png)