Best Accounting Software

Best accounting software options are Zoho, TallyPrime, QuickBooks, Xero, FreshBooks, and Vyapar. Such bookkeeping and accounting systems help company owners in managing accounts receivable and accounts payable efficiently. SoftwareSuggest listed and reviewed popular accounting software based on product costing, features, functions, region, end-use industry, and genuine user reviews and ratings.

No Cost Personal Advisor

List of 20 Best Accounting Software

Best-in-class Cloud Accounting & Financial Managem

Sage Intacct is a cloud-based financial statement solution designed for small and mid-sized businesses. This robust and innovative software automates critical finance and accounting processes besides providing users with real-time financial insights. Read Sage Intacct Reviews

Explore various Sage Intacct features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Sage Intacct Features- Accounting

- Fund accounting

- Purchase Orders

- Accounts Receivable

- For Hospitality Industry

- Expense Tracking

- Financial Management

- Distribution Management

Sage Intacct Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Process-driven CRM for marketing, sales, service.

Creatio is the global supplier of no-code platform for industry workflows automation and CRM. Creatio’s customers enjoy the freedom to own their automation. Freedom is provided through unlimited customization, the ability to build apps without a line of code and a universe of ready-to-use templates and connectors. Read Creatio Reviews

Explore various Creatio features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Creatio Features- CRM & Sales Reports

- Interaction Tracking

- Team Management

- Contract Management

- Performance Management

- Sales Quotes

- Developer API

- Email Integration

Creatio Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Accounting Software by Oracle NetSuite North America

NetSuite, the #1 cloud ERP, is an all-in-one bookkeeping and accounting software that helps more than 29,000 organizations operate more effectively by automating core processes and providing real-time visibility into operational and financial performance. Read Oracle NetSuite ERP Reviews

Explore various Oracle NetSuite ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Sales Forecasting

- Taxation Management

- Budgeting & Forecasting

- Job Costing

- Business intelligence (BI)

- Invoice

- Manage Customers and Suppliers

- Supplier and Purchase Order Management

Oracle NetSuite ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Best Software for Accounting Firms to Manage Financial Reporting

Xero is award-winning web-based accounting software for small business owners and their accountants. It is beautifully designed and easy to use online bookkeeping for expense management. Read Xero Accounting Reviews

Explore various Xero Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Xero Accounting Features- Inventory Management

- Loan & Advances Management

- Time Tracking

- Invoice

- Task Management

- Taxation Management

- Supplier and Purchase Order Management

- Multi Currency

Pricing

Xero Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Advanced payment management software

We offer a fully certified and advanced payment management software suitable for every online business, ranging from banks and payment providers to financial organizations and e-commerce companies Read Paytiko Reviews

Explore various Paytiko features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Paytiko Features- Transaction History

- A/B Testing

- Compliance Management

- Automate IT Tasks

- Cost Tracking

- Subscription Management

- Campaign Analytics

- Frictionless Monitoring

Paytiko Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Free Accounting software for US businesses

Melio is a free Accounting software for small businesses in the US. It allows businesses to pay vendors using bank transfers for free or through credit/debit cards, while the vendors get paid via a bank transfer or a check. Read Melio Reviews

Explore various Melio features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Melio Features- Fraud detection

- Accounts Receivable

- ACH Payment Processing

- Mobile Payments

- Billing Portal

- Customizable invoices

- Duplicate Payment Alert

- Payment Tracking

Pricing

Melio Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Accounting made easy, fast, and secure

Freshbooks is modern business accounting software that simplifies bookkeeping and captures expenses in real-time. This innovative and user-friendly accounting and bookkeping software enables you to manage your invoices digitally, track time, and know about your finances through detailed real-time reports. Read FreshBooks Reviews

Explore various FreshBooks features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all FreshBooks Features- Invoice

- Stock Management

- VAT / CST / GST Reports

- Late Fee Calculation

- Invoice Management

- Budgeting

- Billing & Invoicing

- ACH Check Transactions

Pricing

FreshBooks Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Accounting and Bookkeeping software

Simple, easy-to-use, and one of the best accounting systems to help you manage your accounts online. You can download 14 days free trial of Zoho books. It's an easy-to-use, software for businesses to manage their finances and stay on top of their cash flow. Read Zoho Books Reviews

Explore various Zoho Books features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Zoho Books Features- Invoicing & Payments

- Multiuser Login & Role-based access control

- Profit & Loss Statement

- Security

- Dashboards & Analytics

- Purchase Management

- Multi Company

- Taxation Management

Pricing

Zoho Books Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Accounting software by Vyapar

Vyapar is the simplest GST-ready accounting system for your businesses. It is user-friendly, and you don't have to waste time learning it. It helps you manage your business digitally, even without accounting knowledge. Expense tracking, cheques, receivables/payables, total stock value, payment reminders, etc., do without the internet!. Read Vyapar Reviews

Explore various Vyapar features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Vyapar Features- Mobile Support

- Reminders

- Purchasing

- Customer Journey Mapping

- Invoice

- Customer Management

- Online invoicing

- QR Codes

Pricing

Silver- Desktop (1 year)

$ 40

Device/Year

Silver- Desktop + Mobile (1 year)

$ 47

Device/Year

Silver- Desktop (3 years)

$ 92

Device/ 3 Years

Vyapar Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Best Accounting Software for Financial Reporting

myBillBook is one of the best bookkeeping and accounting software designed to help you manage your business finances using mobile or desktop. No prior accounting knowledge is needed to use this software. You can create bills, maintain stock, track payables/receivables, etc. Read myBillBook Reviews

Explore various myBillBook features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all myBillBook Features- Balance Sheet

- Payment Processing

- Accounting

- Invoice templates

- E-Way Bill Generation

- Online invoicing

- Sales Reporting

- Sales Management

Pricing

Silver Plan

$ 0

Per Month

Diamond Plan

$ 3

Per Month

Platinum Plan

$ 3

Per Month

myBillBook Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Leading cloud-based account software solution

Oracle Fusion Cloud accounts software is a cloud-based, end-to-end business management solution with advanced accounting features for mid to enterprise-level customers. Read Oracle Fusion Cloud ERP Reviews

Explore various Oracle Fusion Cloud ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Audit Trail

- Business intelligence (BI)

- Version Control

- Campaign Management

- Accounting Integration

- Data Mapping

- Collaboration

- Job Management

Oracle Fusion Cloud ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

A Complete GST Compliant Accounting Software

TallyPrime is India’s leading accounting system for small businesses with GST, inventory tracking, banking, and payroll. TallyPrime is one of the best accounting software solutions providers, It is affordable and one of the most popular tools used by nearly 20 lakh+ businesses worldwide. Read TallyPrime Reviews

Explore various TallyPrime features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all TallyPrime Features- Job Work

- Budgeting

- Compliance Management

- Bonus

- Integrated payment processing

- Integrate Different Payment Gateways

- Document Printing

- Annual Filings

TallyPrime Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Handle All Your Accounting Operations With Ease

The comprehensive accounting system has financing, billing, revenue-tracking, accounting, financial management, and reporting modules built in. This business accounting software is capable of maintaining all your data on the cloud. Gain daily cash balance and real-time visibility across the business with 24/7 access from any browser. Read Oracle NetSuite ERP Reviews

Explore various Oracle NetSuite ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Social Media Integration

- Invoice Processing

- Lead Distribution

- Consolidation / Roll-Up

- Market Analysis

- Email Marketing

- Supply Management

- Scheduled / Automated Reports

Oracle NetSuite ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Bigsun is a tailor-made and low-cost accounting software

If you are looking for a more affordable and tailored accounting solution, then Bigsun is the perfect choice for you. Bigsun accounting system is a low-cost software solution that is designed to be customized to the specific needs of your business Read Bigsun ERP Reviews

Explore various Bigsun ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Bigsun ERP Features- Financial Reporting

- Manage Customers and Suppliers

- MIS Reporting Capabilities

- Client Portal

- Financial Accounting

- Accounts Receivable

- Accounting Integration

- Inventory control

Bigsun ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best accounting software for accountants and tax practitioners

Saniiro offers a comprehensive accounting system and reduces your manual work considerably through automated GST reports. This billing cum inventory and accounting system allows you to receive comprehensive reports and insights without much hassle. Read SANIIRO Reviews

Explore various SANIIRO features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all SANIIRO Features- Analytics

- Software Inventory

- Stock Management

- Accounting

- Bills of Material

- Customizable Billing

- Billing Rate Management

- Inventory control

Pricing

SANIIRO BAIMS STANDARD

$ 139

Per Year

SANIIRO BAIMS BASIC

$ 14

Per Year

SANIIRO BILLING LITE

$ 83

Per Year

SANIIRO Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

Best Accounting Software for Small Businesses

Deskera All-in-One is an integrated accounting tool for all your business needs. Move your business to the cloud in a few minutes. Get a real-time view of your business with a dashboard to visualize all aspects of your business at a glance. Read Deskera Reviews

Explore various Deskera features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Deskera Features- Drag & Drop

- ACH Check Transactions

- Bookkeeping

- Activity Tracking

- HR & Payroll

- Accounting Integration

- Financial Reporting

- Banking Integration

Pricing

Professional

$ 83

User/Month

Startup

$ 17

User/Month

Essential

$ 42

User/Month

Deskera Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Contenders | 2024

100% free accounting system for your business

Wave's accounting solution is 100% free, secure, and accountant-approved. Use Wave Accounting to connect your bank accounts, sync your expenses and balance your books to ensure you're ready for tax time Read Wave Accounting Reviews

Explore various Wave Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Wave Accounting Features- General Ledger

- Production Management

- Project Accounting

- Project Management

- Partnership Accounting

- Financial Accounting

- Accounts Receivable

- Online Accounting

Pricing

Accounting Software

$ 0

Forever

Wave Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

High Performer | 2024

Manage your payables and receivables faster

MARG ERP 9+ is fast and secure accounting software that helps you streamline and digitize all your finances. It allows you to generate reports and invoices in thousands of formats and automatically reconcile transactions with over 140 banks. Read MARG ERP 9+ Accounting Reviews

Explore various MARG ERP 9+ Accounting features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

- Bills of Material

- Budgeting

- Accounts payable

- Taxation Management

- HR & Payroll

- Payment Gateway Integration

- Service Tax

- TDS / TCS

Pricing

Basic Edition

$ 113

Full Licence/ Single-User

Silver Edition

$ 175

Full Licence/ Single-User

Gold Edition

$ 350

Full Licence/ Multi-User

MARG ERP 9+ Accounting Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Emergents | 2024

Integrated accounting software for small business

Fraxinus Books offers a GST-ready billing and accounting system ideal for conglomerates and large enterprises. This accounting solution can be operated using any device and can also be used online or offline. Read Fraxinus Books ERP Reviews

Explore various Fraxinus Books ERP features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Fraxinus Books ERP Features- Sales Management

- Point of Sale (POS)

- Business intelligence (BI)

- Financial Accounting

- Bank Reconciliation

- Reporting/Analytics

- Transport / Fleet management

- Invoice Processing

Pricing

Standard version

$ 181

Onetime

Fraxinus Books ERP Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

Category Champions | 2024

Streamline Your Accounting & Sales

Refrens is an all-in-one business operating system consisting of accounting & bookkeeping system, lead management, inventory & expense management, profile & networking system, and more. Read Refrens Reviews

Explore various Refrens features, compare the pricing plans, and unlock the potential of seamless operations by selecting the right software for your business.

Features

View all Refrens Features- Financial Management

- Online Invoice Payment

- Multi-Branch

- Accounting

- Multi-Store Management

- Credit Card Processing

- Customer DataBase

- Invoice Designer

Pricing

Basic

$ 0

Per Business/ Annum

Books

$ 42

Per Business/ Annum

Books Pro

$ 104

Per Business/ Annum

Refrens Caters to

- StartUps

- SMBs

- Agencies

- Enterprises

For business owners and managers, managing finances can pose a significant challenge. However, streamlining accounting processes through automation can reduce errors and enhance productivity. Utilizing the right accounting software not only facilitates accurate financial reporting of vital indicators such as balance sheets, cash flow statements, and income statements but also ensures efficiency.

Selecting the optimal accounting software for your business can be daunting due to the plethora of options available. A comprehensive buyer's guide can aid in making an informed decision by outlining key factors to consider when choosing accounting software.

This guide helps in navigating the market and selecting the solution best suited to your company's needs, ultimately optimizing financial management processes.

What is Accounting Software?

Discover the power of accounting software for seamless financial management in your business. Streamline accounting processes, manage payables and receivables, and generate accurate financial statements effortlessly. Explore advanced features designed to optimize your financial operations and enhance business efficiency.

Firms of all magnitudes, from small-scale startups to big companies, generally utilize accounting software to maintain orderliness and conformity with financial laws. There are numerous accounting software alternatives offered in the market, with distinct characteristics, costs, and graphical user interfaces, enabling firms to select the one that fits their requirements most suitably.

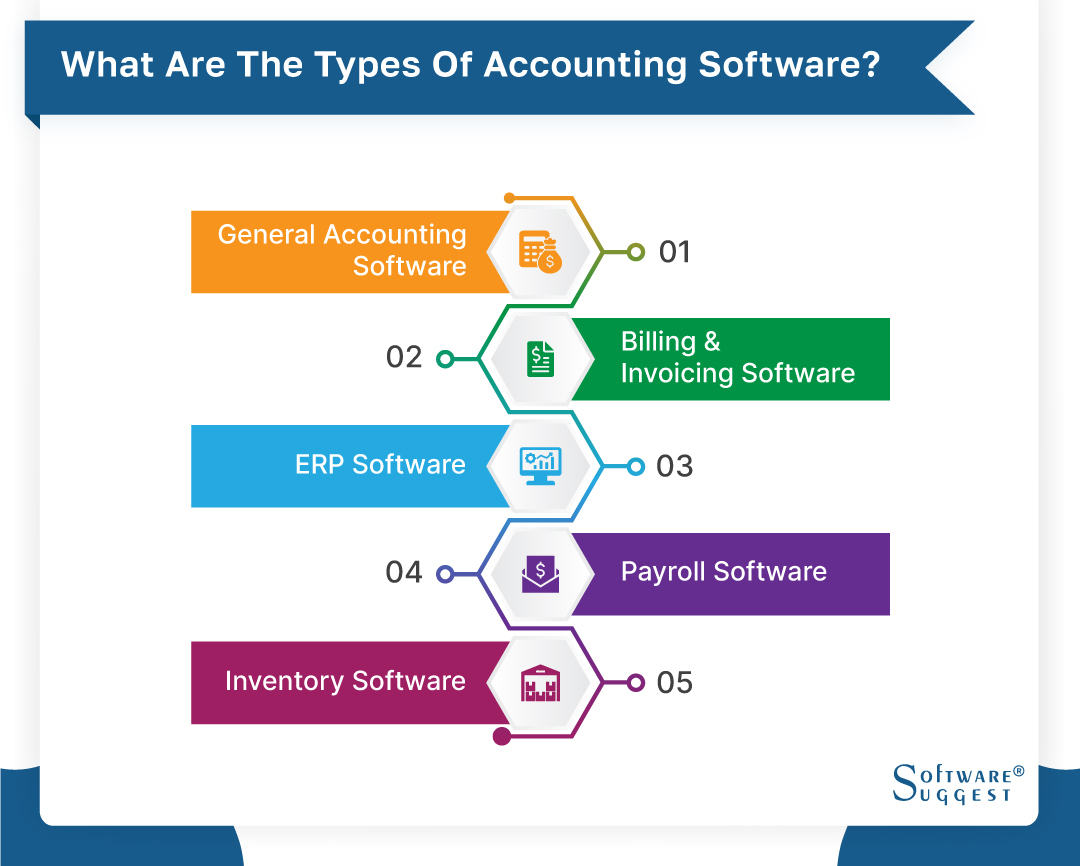

What are the Types of Accounting Software?

Regarding accounting software, there are multiple variations accessible in the marketplace. Every variation has its distinct attributes and advantages, and enterprises must select the most suitable one according to their requirements. In this segment, we will converse about the diverse types of accounting software.

-

General accounting software

General accounting software encompasses a variety of tools tailored to address the fundamental financial management requirements of businesses and organizations. Offering a wide array of features and capabilities, this software streamlines and automates various accounting tasks, providing efficiency and convenience in managing financial operations.

The capability of general accounting software to manage and track financial transactions is a crucial component. It enables users to enter and organize assets, liabilities, assets, and revenue to produce accurate and recent financial reporting. Features including general ledger administration, accounts payable and receivable, bank reconciliation, and financial statement production are frequently offered by these software packages. -

Billing and invoicing software

Software for billing and invoicing is a helpful resource for establishments that need to effectively manage their money. It enables users to quickly and easily produce and send invoices to their clients that look professional. These software programs frequently provide features like editable templates, payment monitoring, and unpaid invoice reminders.

The potential of billing and invoicing software to mechanize functions, like repeated invoices and payment alerts, is among its primary benefits. It can boost a company's cash flow and reduce time and energy expended. With the assistance of numerous billing and invoicing software options that can be merged with other accounting software, users can effortlessly monitor their invoices and payments..

-

ERP (Enterprise Resource Planning) software

Accounting, human resources, inventory, and sales are just a few of the many company activities that can be managed using enterprise resource planning (ERP) software. Establishments may manage their financial data centrally, automate repetitive procedures, and streamline operations with the help of ERP software. It combines data from several departments, facilitating improved collaboration and more informed choice-making.

Larger companies that need to manage intricate financial transactions and maintain goods across numerous locations will find ERP software to be very helpful. Establishments may generate financial reports, handle client orders, and keep track of inventory in real-time with ERP software.

-

Payroll management software

Establishments that need to handle employee payroll and guarantee accurate and timely payments must use payroll management software. Many of the laborious steps in payroll management, such as determining employee compensation, producing pay stubs, and managing tax withholdings, are automated by this kind of software. By automatically calculating and withholding taxes from employee paychecks, payroll management software can also assist firms in adhering to tax laws.

Establishments of all sizes, from small startups to major enterprises, can use payroll administration software. The program is adaptable to each company's particular requirements, and it supports a variety of payment schedules, payment options, and employee perks. Payroll administration software may also be integrated with other accounting and HR programs to offer a complete package for managing establishment finances and personnel data.

-

Inventory management software

Inventory management software is a specialized type of accounting software that focuses on effectively tracking, managing, and optimizing an organization's inventory. Businesses can utilize the tools and services it offers to simplify inventory-related procedures, assuring effective stock management and precise financial reporting.

Inventory tracking is one of the main purposes of inventory management software. It enables companies to keep tabs on inventory levels and keep records of information, including volumes, locations, and stock movements. Establishments may make informed choices about their sales, replenishment, and procurement plans because of this real-time visibility.

What are the Benefits of Accounting Software?

Accounting software has evolved into a vital resource for establishments of all sizes. Accounting software enhances business operations by automating financial procedures and supplying real-time access to financial data. We'll go through the top benefits of accounting software in this section.

-

Saves time with automation

Accounting software is an effective tool that may assist companies with automating many of their financial processes, including creating invoices, processing payments, and balancing accounts. When performed manually, these procedures can be time-consuming and can produce errors that can be expensive to correct. However, establishments can save time and lower the chance of errors by utilizing accounting software, allowing them to concentrate on other elements of their operations.

-

Real-time data access

Real-time access to financial data for organizations is one of the main advantages of accounting software. This gives them a precise and current picture of their financial performance, enabling them to act swiftly and wisely in the face of shifting market conditions. Businesses may more efficiently monitor their cash flow, costs, and sales with real-time data and, if necessary, take remedial action.

-

Improved visibility

Financial software enables enterprises to produce comprehensive monetary statements, which can furnish them with better insight into their financial condition. With more precise financial data, enterprises can make better-informed judgments and enhance their overall financial well-being. The capacity to create financial reports quickly and effortlessly is a crucial advantage of financial software, as it helps establishments to monitor their financial performance and pinpoint areas for enhancement.

-

Better collaboration

Multiuser access to financial data is made possible by accounting software's central platform. As a result, departments can work together more effectively and collaboratively, improving overall productivity. Accounting software enables staff from many departments to access and update financial data instantly, lowering the possibility of errors that may arise when transferring data manually between several spreadsheets or systems.

-

Streamlined tax filing

One of the major benefits of accounting software is streamlined tax filing. Establishments can simplify and automate the tax filing process with accounting software, which might otherwise be time-consuming and complex. Accounting software frequently includes tools that let businesses create the required tax forms and calculate taxes automatically. This lowers the possibility of mistakes and guarantees correct and timely tax submissions.

-

Cost-effective

Businesses wishing to simplify their financial procedures may find accounting software to be a cost-effective option. Establishments can reduce manpower and administrative costs by automating financial operations like reconciliation and invoicing. Accounting software can also give users access to real-time financial data, empowering companies to act swiftly and intelligently in response to market changes.

-

Enhanced security

Accounting software offers robust security features that ensure the protection and preservation of financial data integrity. Encryption and access controls are among the common measures employed to secure sensitive financial information from unauthorized access or potential cyber threats. By implementing these stringent security measures, businesses can decrease the likelihood of financial fraud and data breaches, thereby upholding their reputation and maintaining their financial health.

-

Automates repetitive tasks

By incorporating a reliable security feature, accounting software proffers the additional advantage of automation. This leads to the eradication of menial and repetitive manual tasks such as data entry and invoicing. Consequently, the employees are liberated from these wearisome and tedious duties. It ultimately empowers them to dedicate their energy and time to more advanced tasks, for instance, such as scrutinizing financial data and making astute and calculated judgments.

By automating accounting responsibilities, there is no chance of human error, which advances the accuracy and reliability of data. In turn, this elevates decision-making and results in fruitful outcomes for the business. By employing accounting software to automate tasks and smoothen operations, businesses can optimize their workflow and enhance overall efficacy.

-

Increased accuracy and reduced mistakes

The utilization of accounting software not only brings forth a plethora of benefits but also serves as a pivotal factor in reducing mistakes and imprecisions in financial data. By making use of this technology, enterprises can attain more precise and error-free financial records. Ultimately this can lead to more knowledgeable decisions and, eventually, an enhancement in overall financial performance.

Making sure financial data is accurate is very important for a successful business strategy. By utilizing accounting software, establishments can ensure that their financial records are exact, trustworthy, and up-to-date. Ultimately empowering them to make better-informed decisions and ultimately achieve greater triumph.

-

Faster accounting processes

Employing accounting software not only eradicates the necessity for manual data entry but also furnishes instantaneous admission to financial data, which empowers businesses to hasten their financial procedures and function more effectively. This is of particular significance in the present fast-paced business milieu, where time is crucial, and swift decision-making can determine the difference between triumph and failure.

With the capability to process financial data promptly and proficiently, businesses can respond promptly to market modifications and take advantage of financial prospects as they emerge. This empowers businesses to stay ahead of their competitors and uphold a competitive edge in the market.

Features of Accounting Software

To handle their financial operations, organizations need accounting software. It has several features that can be used to improve overall efficiency, decrease errors, and streamline financial procedures. Here we'll see the top features of accounting software, outlining their advantages and how they might assist companies in achieving their financial targets.

-

Accounts payable

One of the most important functions of accounting software is accounts payable. With the help of this function, businesses may handle their outstanding bills efficiently, cutting down on the likelihood of late fines and missed payments. By automating processes like invoice production and payment processing, accounts payable software is intended to simplify the management of vendor payments. Establishments can save time and money by automating these procedures rather than managing their payable invoices by hand.

-

Accounts receivable

Accounting software plays a vital role in managing cash flow through its accounts receivable module. This tool enables businesses to efficiently invoice customers, track outstanding payments, and automate tasks such as invoice generation and payment monitoring. Additionally, the software provides insights into customer payment history, helping businesses identify late-paying clients or those at risk of default. This information facilitates informed decisions regarding credit management and client relations.

-

Bank reconciliation

Bank reconciliation is a crucial process for ensuring financial accuracy in businesses. This involves manually comparing bank account balances with accounting records, but automation through bank reconciliation software reduces errors and saves time. The software allows easy import of bank statements, simplifying transaction comparison and error detection. It provides real-time access to cash flow, aiding informed financial decisions. Furthermore, by identifying unexpected transactions, the software helps uncover fraud and anomalies in a more efficient manner.

-

General ledger

The foundation of any accounting system is the general ledger, which is responsible for accurately recording all financial transactions. In cloud-based accounting software, the general ledger function streamlines this process, reducing errors and improving accuracy. Businesses can record various transactions, such as accounts payable, accounts receivable, and wages, using this feature.

-

Financial reporting

The essential financial reporting feature in accounting software provides organizations with crucial information about their financial health. It allows companies to generate reports displaying key figures like revenue, costs, profits, and losses. This tool offers real-time visibility, enabling businesses to make informed financial decisions and adjust strategies as needed. Financial reporting software not only helps identify trends and patterns but also provides real-time insights for making strategic choices and operational adjustments. By utilizing this software, businesses can enhance financial performance and stay competitive.

-

Billing & invoicing

Accounting software includes a crucial billing and invoicing component that streamlines financial operations for companies. This feature automates invoice creation, reducing errors and enhancing billing efficiency. Businesses can track project expenditures like labor and material costs, ensuring accurate project financials. With this software, small firms can create and track invoices, ensuring prompt payments and minimizing billing errors through automated processes

-

Fund accounting

Accounting software features fund accounting, specially designed for governmental and nonprofit organizations with unique financial requirements. Fund accounting software facilitates intricate financial procedures, including recording donations and grants, expense control, and report generation. Its real-time visibility into an organization's financial condition allows informed decision-making and keeps stakeholders informed. For nonprofits, ensuring transparency and meeting regulatory requirements, such as tax reporting and audit trails, is crucial, making fund accounting software, like Sage Business Cloud, particularly valuable..

-

Project accounting

To assist firms in properly managing their projects, accounting software must have a crucial function called project accounting. Establishments can use it to manage budgets, create reports that offer real-time visibility into project performance and track project-related costs and income. Firms can efficiently manage resources and generate project budgets with project accounting software, ensuring that projects are completed on schedule and within budget.

Businesses can track project-related expenditures, including labor costs, material costs, and other costs related to finishing a project using this function as well. With the help of software for small businesses, firms can also create invoices and keep track of project-related payments, assuring prompt payments and lowering the possibility of missed or wrong billing.

-

Expense tracking

Keeping a record of expenditures is a vital feature of accounting software that helps businesses in handling their outlay. It allows them to record and categorize all their expenses in one place, making it easier to track their expenses and cash flow. This feature also helps establishments to identify where their money is going and whether they are spending excessively in certain areas or not.

By analyzing their expenses, enterprises can identify prospects to decrease costs, enhance efficiency, and boost profitability. Expense tracking software also ensures that establishments comply with tax regulations by guaranteeing that they maintain precise records of all their expenses. All in all, expense tracking is a valuable instrument that assists enterprises in managing their finances effectively and making well-informed decisions regarding their spending

-

Multi-currency support

Accounting software that supports several currencies is essential for companies that operate internationally or transact with clients and suppliers in many currencies. This function enables companies to precisely record transactions in local currency and convert currency values.

Businesses can examine financial statements in several currencies with multi-currency capability, which makes it simpler to evaluate the financial health of the company across various areas. Accounting software that supports multiple currencies can also assist organizations in adhering to local tax rules and regulations. Businesses that frequently interact internationally and need to monitor exchange rates to control currency risk should pay particular attention to this feature.

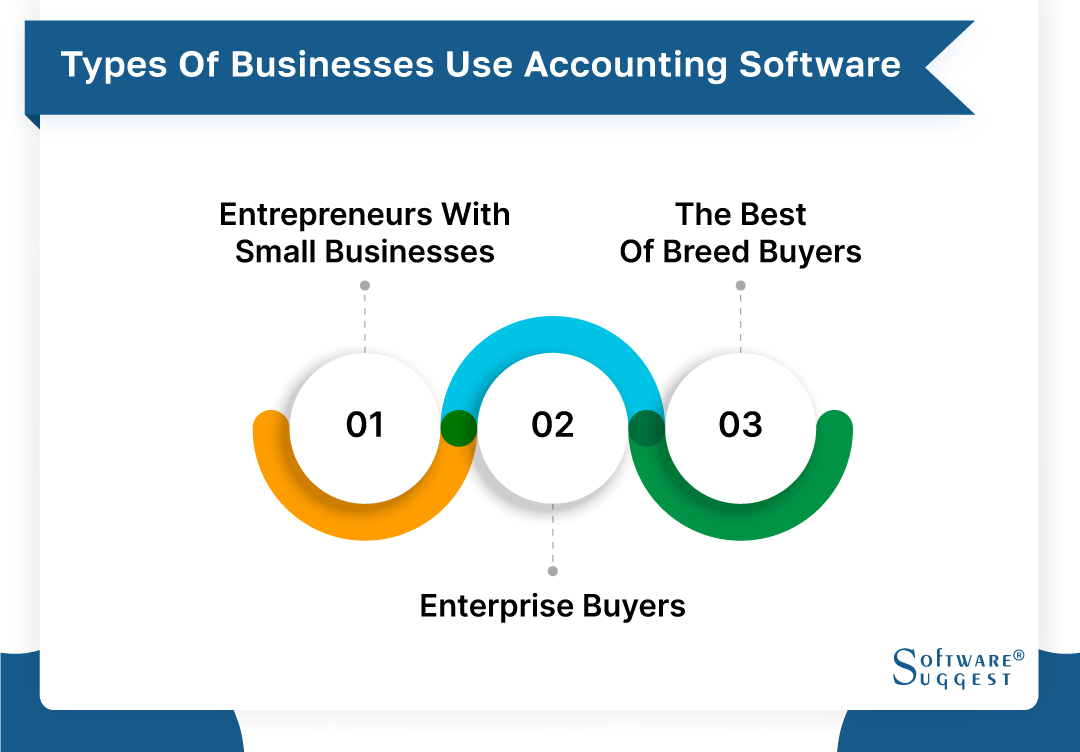

What Types of Businesses Use Accounting Software?

When it comes to picking accounting software, it is crucial to comprehend the kind of purchaser you are. Distinct purchasers possess diverse needs and prerequisites, and choosing the appropriate software can have a remarkable impact on the triumph of their enterprise. Broadly speaking, there are three categories of purchasers: business owners with minor enterprises, corporate purchasers, and top-quality purchasers.

-

Entrepreneurs with small businesses

Small business owners have certain requirements for accounting software. They often have a restricted budget and want software that is versatile, inexpensive, and simple to use. They can also require software that can expand along with their company. Cloud-based accounting software is frequently the best option for these customers. Software that runs in the cloud is affordable, scalable, and needs little to no IT infrastructure. With lots of customization choices, it is also user-friendly.

Small business owners frequently choose QuickBooks Online, Xero, and FreshBooks as their accounting software. These software alternatives all utilize the cloud and provide a variety of functions like expenditure monitoring, invoicing, and financial reporting. With membership rates starting at only a few dollars each month, they are also reasonably priced.

-

Enterprise buyers

Typically, enterprise purchasers are larger companies with sophisticated financial requirements. They require software that can combine financial statements, handle numerous currencies, and interface with other systems. Traditional on-premise ERP software is frequently the best option for these customers. Although this software is pricey, it offers security and capability at the enterprise level.

For commercial buyers, SAP, Oracle, and Microsoft Dynamics are a few of the well-liked choices. All of these software choices are installed locally and need substantial IT infrastructure and upkeep expenditures. However, they provide a variety of features, including management of finances, the supply chain, and human resources. Additionally, they offer sophisticated reporting and analytics features, which can assist enterprise customers in making fact-based decisions.

Enterprise software customers might also want to take cloud-based ERP into consideration. The functionality of cloud-based solutions may not be as high as that of on-premise systems, but they do offer more scalability and flexibility. Additionally, they demand less initial outlay and regular upkeep. Options for cloud-based ERP software include Sage Intacct, Acumatica, and NetSuite.

-

The best-of-breed buyers

Businesses that prefer to use the best software for each specific purpose over an all-in-one solution are known as best-of-breed purchasers. For instance, they might select one software package for payroll management, another for time and expense management, and so forth. Instead of opting for a less-than-ideal all-in-one solution, this strategy enables firms to choose the best software for each specific function.

For each specific function, best-of-breed purchasers might wish to think about cloud-based solutions. Compared to on-premise choices, cloud-based solutions are frequently more affordable and simpler to use.

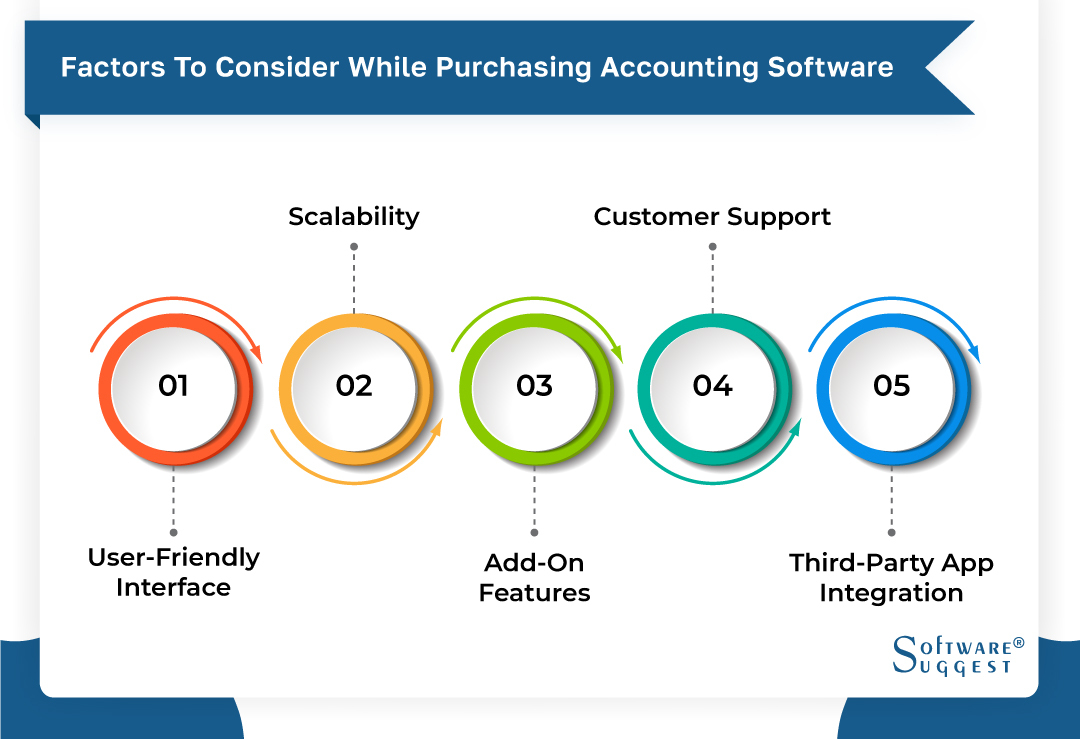

Factors to Consider While Purchasing Accounting Software

Purchasing accounting software might be difficult if you are unfamiliar with the features and options offered. Here are some important factors to think about while buying accounting software.

-

User-friendly interface

When it comes to accounting software, a user-friendly interface is essential. The software should have an intuitive layout and be simple to use. This is crucial for establishments that need software that anyone can use but may not have accounting professionals on staff.

The small business accounting software should offer clear instructions for operations like issuing invoices, controlling spending, and generating reports, and the interface should make it simple to enter data. The learning curve can be shortened, and the accounting process can be more effective.

-

Scalability

Another crucial aspect to think about when purchasing accounting software is scalability. You want to ensure that your software can expand along with your firm as it grows. Be on the lookout for software that can accommodate an expanding user base and manage more data.

Additionally, you should think about software that can be integrated with other programs you might require as your company grows, including inventory management or CRM programs. By preventing the need to transition to a different system later on, scalable software can assist save time and money in the long term.

-

Add-on features

It's necessary to take into account add-on features that can be advantageous for your company in addition to the essential accounting features. Features like project management, time monitoring, and inventory management are available in some accounting software. These capabilities can help you streamline your processes and save time, depending on your company's demands.

For instance, project management and time-tracking tools can assist you in managing client projects and keeping track of billable hours if your company provides services. Consider which add-on features are most crucial for your company before choosing the best accounting software for small businesses, then hunt for options that provide those functions.

-

Customer support

When buying accounting software, good customer service is crucial. Make sure you can get assistance if you encounter problems or have inquiries regarding the software. Search for software companies that provide helpful customer service via phone, email, or chat.

The amount of help provided, such as whether it is accessible 24/7 or merely during work hours, should also be taken into account. To help you become familiar and easy with using the product, certain software vendors might also provide training materials like webinars or tutorials. Your accounting procedures can run more efficiently and lessen the possibility of mistakes or delays with the help of good customer support.

-

Third-party app integration

Another thing to think about when purchasing accounting software is integration with outside applications. For duties like project management, inventory management, or customer relationship management, many firms employ different software programs. Your operations can be made more efficient, and you can do away with the necessity for manual data entry by integrating these apps with your accounting software.

Find software that can be integrated with any third-party applications you currently use or may require in the future. Pre-built connectors are available from some software vendors, but others could need specialized development. You can save time and lower the possibility of mistakes or inconsistent data by selecting software that interfaces with your other software programs.

List of Popular Accounting Software with Pros and Cons

Accounting software is a crucial tool for establishments of all sizes, as it helps in managing financial transactions, tracking expenses, and generating reports. There is a wide plethora of accounting software options available in the market, each providing unique features and benefits. Let's look at the top 5 trending accounting software in India:

-

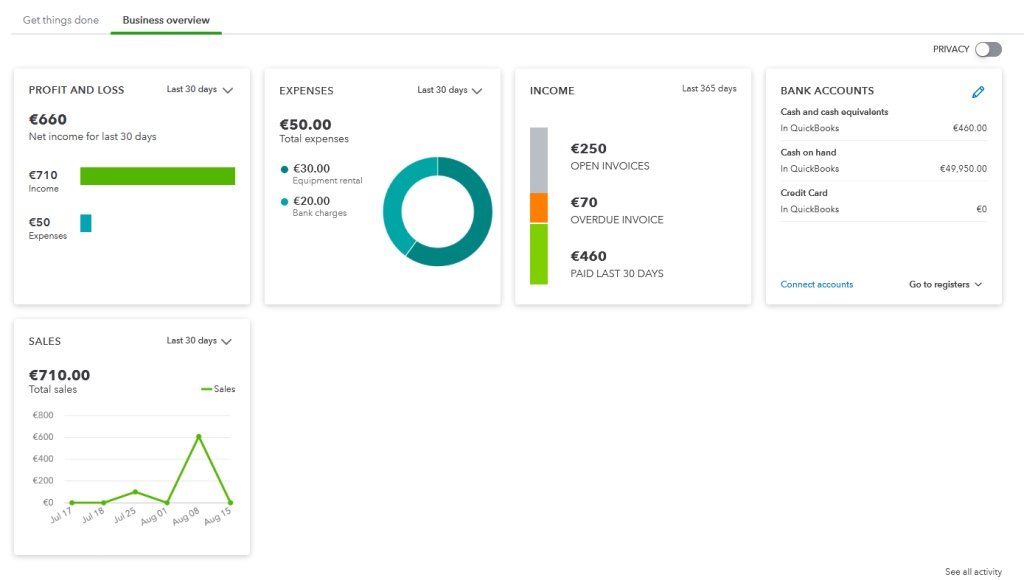

QuickBooks

Why Choose QuickBooks?

The best business accounting software includes inventory management features, sharing recent transactions, and accepting bulk payments. In addition, it provides companies with a single point of contact to streamline back-office operations and all financial transactions.

QuickBooks is a highly versatile accounting software that is ideal for small to medium-sized establishments. It is an all-in-one solution that makes accounting operations easier because of its extensive feature set, which includes inventory management, payroll management, and bank reconciliation.

Features

- Invoice creation

- Track expenses

- Manage bills

- Get tax deductions

- Run reports

- Track miles

- Manage projects

- Calculate sales tax

- Manage e-commerce

Pros

- It is easy to use and does not require any accounting knowledge

- It offers a range of customization options, allowing users to tailor it to their specific needs

- It provides a range of integrations, making it easier to sync with other software programs and platforms

- It offers a mobile app, allowing users to manage their finances on the go

Cons

- Customer support can be slow and unresponsive at times

- The software can be slow and laggy, particularly for larger businesses with more extensive financial data

Pricing

- Simple start- $ 15 per month

- Essentials- $ 27.50 per month

- Plus- $ 42.50 per month

- Advanced- $ 100 per month

-

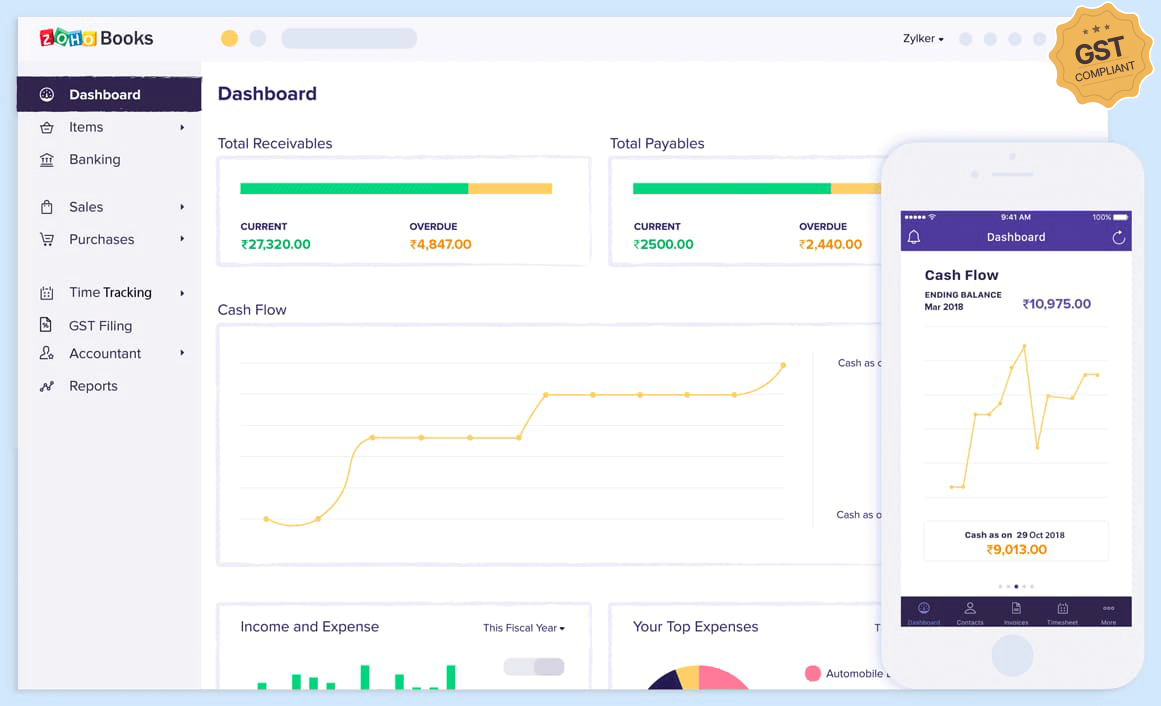

Zoho Books

Why Choose ZOHO?

The best bookkeeping software and software used in accounting, Zoho Books can be used on either mobile or desktop. You can make bills, maintain stocks, track payables and receivables, and more.

Zoho Books is a cloud-based accounting software program that provides a range of features that are well-suited for small establishments. It provides a complete financial management solution with its invoicing, cost tracking, project management, and inventory management functions. The software is a great option for firms who currently use other Zoho products because it seamlessly integrates with them.

Features

- Invoice templates

- Account reconciliation

- Customer portal

- Expense management

- Contact management

- Financial reporting

- Document management

- Vendor Portal

Pros

- Zoho Books is affordable, with a range of pricing plans to choose from

- The software offers a range of automation features, such as recurring invoices and payment reminders, making it easier to manage financial transactions

- Zoho Books provides excellent customer support, with live chat, phone, and email support available

- The software offers integrations with a range of other software programs, making it easier to sync with other platforms

Cons

- Zoho Books can be overwhelming for users who are not familiar with accounting software, particularly with its extensive range of features

- Some users have reported issues with the software's reporting capabilities, with limited customization options available

- The mobile app can be slow and buggy at times

Pricing

- Standard- $9.11 per organization per month

- Professional- $18.24 per organization per month

- Premium- $36.48 per organization per month

- Elite- $60.19 per organization per month

- Ultimate- $79.31 per organization per month

-

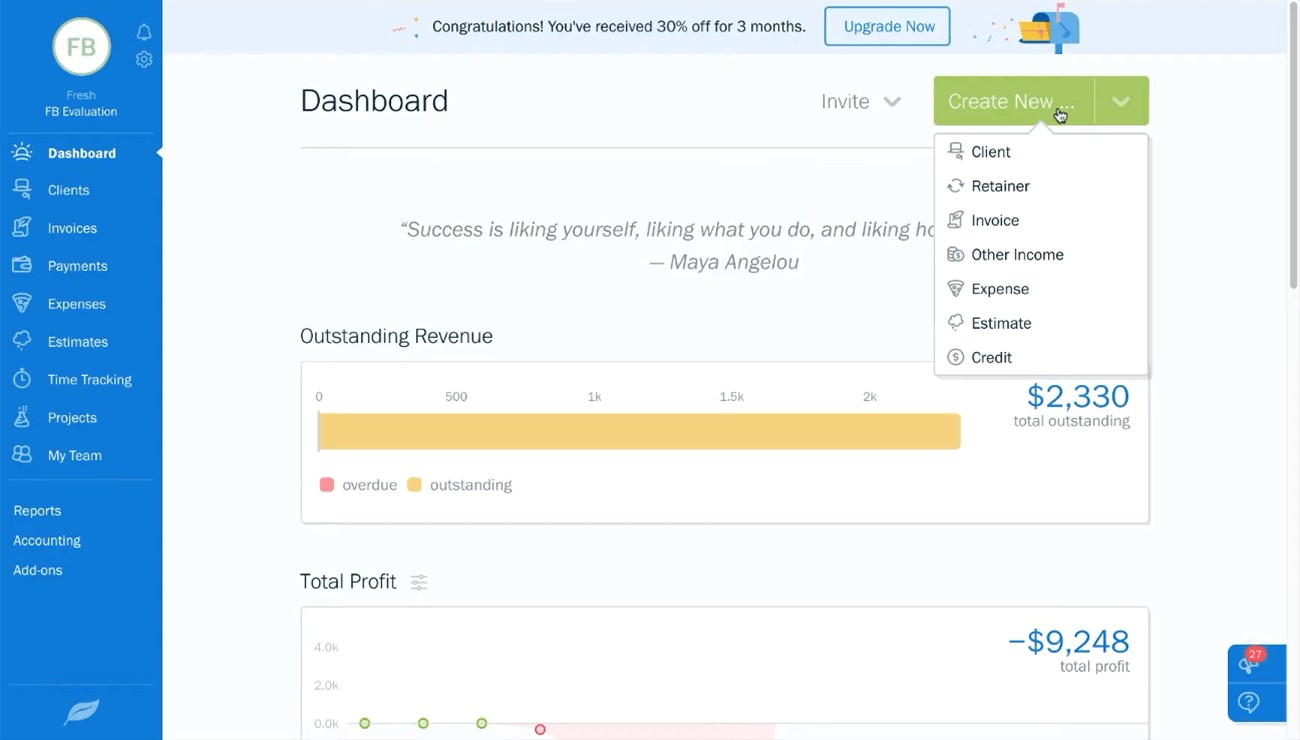

FreshBooks

Why Choose FreshBooks?

FreshBooks is the most uncomplicated GST-ready accounting management system, invoicing, and inventory management software available anywhere. It is specifically designed for small businesses with an easy-to-use interface to assist you in managing your small business digitally.

FreshBooks is a cloud-based accounting software program that is specifically designed for small businesses and freelancers. It provides a complete solution for handling finances with its invoicing, time tracking, project management, and cost tracking tools. Users with little experience in accounting will find the software package to be very user-friendly and simple to use.

Features

- Balance sheet

- Trial balance

- General ledger

- Accounts payable

- Cost of goods sold

- Reports

- Mileage tracking app

- Bookkeeping

Pros

- FreshBooks is easy to use and does not require any accounting knowledge

- It offers a range of personalization options, allowing users to enjoy it to their specific needs

- FreshBooks provides excellent customer support, with live chat, phone, and email support available

- The software offers integrations with a range of other software programs, making it easier to sync with other platforms

Cons

- The software has limited reporting capabilities, with users reporting issues with generating custom reports

- FreshBooks does not offer inventory management features

Pricing

- Lite- $ 8.50 per month

- Plus- $ 151.50 per month

- Premium- $ 27.50 per month

-

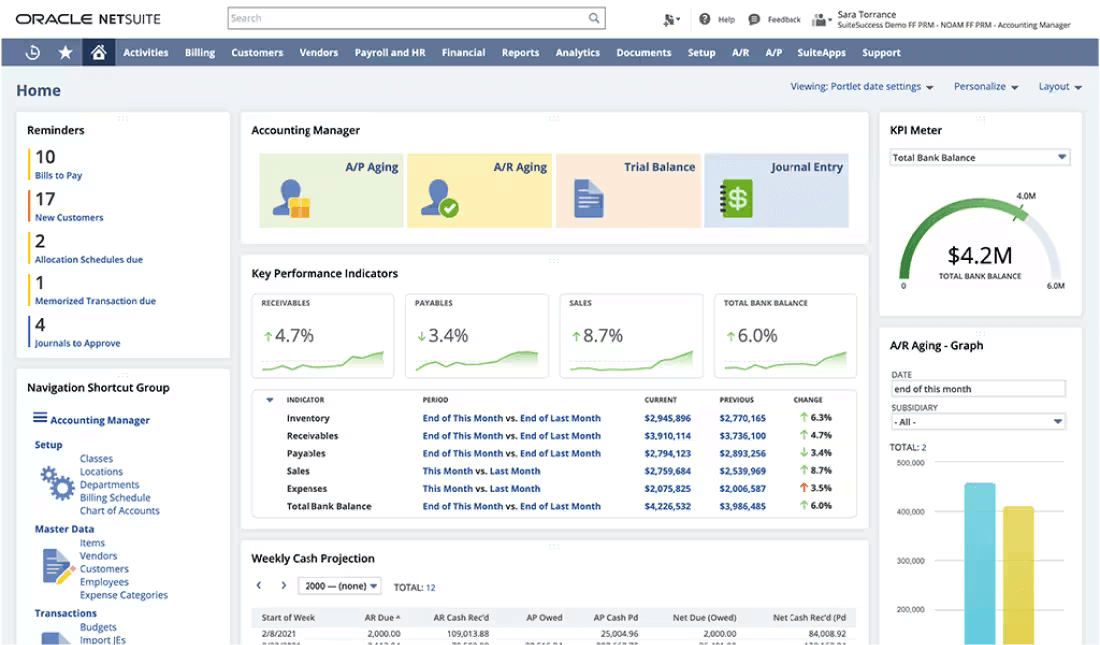

Oracle NetSuite

Why Choose Oracle NetSuite?

A leading business management solution in the world, Oracle NetSuite is a robust accounting management system, stock control, financial calculation and reporting, and a full-service payroll solution. Small and medium businesses can use it at no additional cost. It is used by more than 2 million businesses worldwide.

Oracle NetSuite is a cloud-based accounting software program that is specifically designed for medium to large businesses. It offers a comprehensive solution for establishments searching for an all-in-one software application with its wide range of accounting software features. It includes financial administration, inventory management, project management, and e-commerce management.

The software application may be adjusted to match the unique demands of each organization and is very customizable. Oracle NetSuite also offers strong reporting and analytics features that give firms insightful data on their financial performance. Oracle NetSuite is a great option for organizations looking for a comprehensive accounting software solution that can grow with them as their demands expand due to its scalability and flexible price structure.

Features

- General ledger

- Cash management

- Accounts receivable

- Accounts payable

- Income and expense tracking

- Tax management

- Close management

- Fixed assets management

- Payment management

Pros

- Oracle NetSuite is a comprehensive solution, providing a range of features that can replace the need for multiple software programs.

- The software offers extensive customization options, allowing users to tailor it to their specific needs.

- Oracle NetSuite provides excellent customer support, with dedicated support teams available for different areas of the software.

- The software offers integrations with a range of other software programs, making it easier to sync with other platforms.

Cons

- Oracle NetSuite can be expensive, particularly for small businesses or startups.

- The software can be complex and overwhelming, requiring training and expertise to use effectively.

- The UI can be confusing and difficult to navigate at times.

Pricing

The company provides custom pricing.

-

Wave

Why Choose Wave?

The comprehensive accounting system includes financial management, billing, revenue tracking, accounting, financial management, and reporting modules. Maintain all your data on the cloud to get daily cash balances and real-time visibility across your business.

Wave is a cloud-based accounting software program that is designed specifically for small businesses. The open-source accounting software provides a straightforward yet complete solution for handling finances with its invoicing, spending tracking, and accounting reports capabilities. Being free software, one of Wave's unique qualities makes it the perfect option for companies on a small budget.

Despite being free, Wave has a lot of capabilities and is easy to use, making it a great choice for individuals with little experience with accounting. Wave also provides interfaces with other apps, enabling users to streamline their processes. Wave is great for small businesses searching for an easy-to-use accounting solution because of its reasonable cost (or lack thereof) and user-friendly layout.

Features

- Billing and invoicing

- Account reconciliation

- Receipt scanning

- Cash flow management

- Payroll management

- Expense tracking

- Third-party integrations

- Tax management

Pros

- Wave is free to use, making it an affordable option for small businesses.

- It is easy to user-friendly and does not require any accounting knowledge.

- Wave offers integrations with a range of other software programs, making it easier to sync with other platforms.

- The software provides excellent customer support, with live chat and email support available.

Cons

- Wave has limited features compared to other accounting software programs, with no inventory management or payroll management features.

- The software has limited customization options, with limited invoice templates available.

- Some users have reported issues with its bank reconciliation feature.

Pricing

It is a free tool.

Challenges Of Accounting Software

Accounting software can assist in making this work simpler and more effective. Managing funds is an essential component of every business. However, deploying accounting software can provide a number of challenges for establishments.

-

Integration with legacy systems

Integrating accounting software with legacy systems is one of the most difficult tasks. Many establishments still employ obsolete software or systems, which can make it challenging to integrate new accounting software without any glitches. Data discrepancies, duplication, and inaccuracies may emerge as a result, which may affect financial reporting and analysis.

-

Data security and privacy concerns

Making sure that data is secure and private is another difficulty with accounting software. Establishments must take appropriate precautions to safeguard sensitive financial data against unauthorized access, breaches, and cyberattacks. This entails putting in place strong security measures, including encryption, access controls, and consistent data backups.

-

Cost of implementation and maintenance

Businesses must consider the cost of software licensing, hardware, and the labor needed for installation and maintenance when implementing accounting software because these expenses might be high. The price of ongoing maintenance, such as software upgrades, bug fixes, and technical assistance, can quickly mount up.

-

User training and adoption

Adequate user training and support are necessary for effective usage of accounting software. Businesses may encounter difficulties, though, in ensuring that staff members are well-trained on how to utilize the program. This could lead to underuse or abuse of the software, which would produce errors and inaccuracies.

-

Limited customization options

The limited customization possibilities available with accounting software present another issue. Businesses have various financial needs, and the software might not be able to meet them all. Businesses may be forced to employ various software programs as a result, which can be time- and resource-intensive.

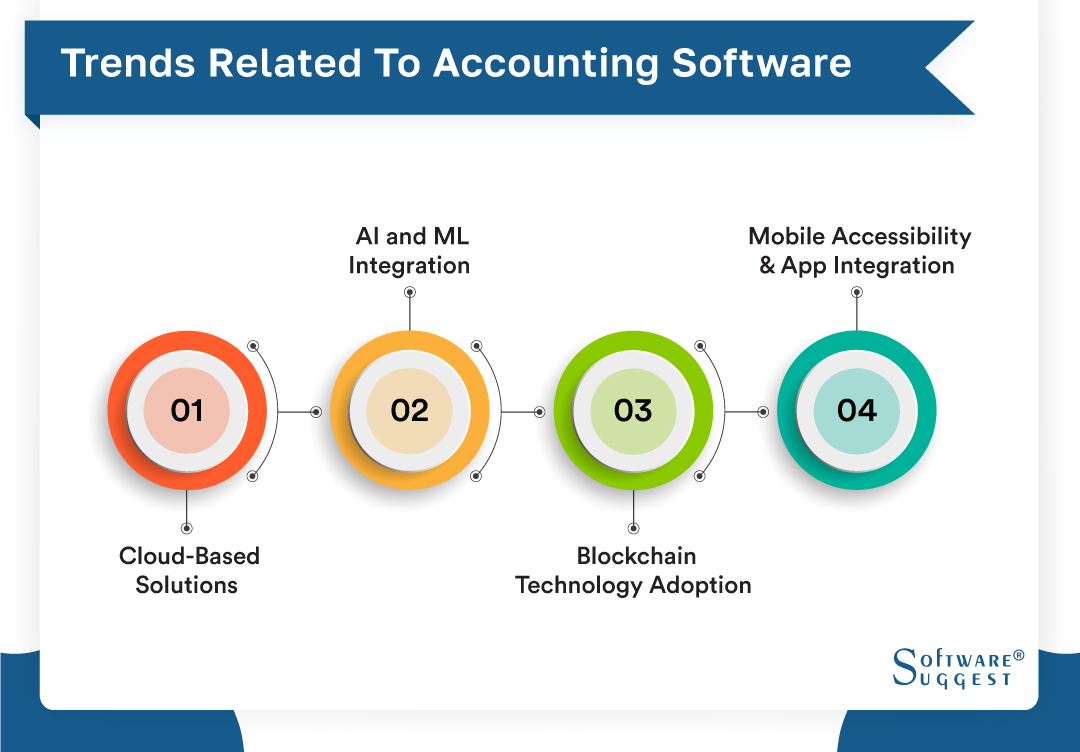

Trends Related To Accounting Software

Despite the challenges, accounting software continues to evolve and improve, offering establishments new features and capabilities. Here are the top 5 trends in accounting software today:

-

Cloud-based solutions

Accounting software that is hosted in the cloud has grown in popularity recently since it gives organizations more flexibility, scalability, and affordability. Real-time access to financial data is another feature of cloud-based solutions that enables organizations to make prompt decisions based on reliable information.

-

Artificial intelligence and machine learning integration

The integration of ML and AI into accounting software is another trend. As a result, firms may automate tedious operations like data entry and increase accuracy and productivity. Additionally, AI and machine learning can offer insightful analyses of financial data that help firms make better choices.

-

Blockchain technology adoption

The accounting sector is embracing blockchain technology as it provides more security, transparency, and accuracy. Accounting systems built on blockchain technology can assist in reducing fraud and mistakes while also improving transaction tracking for establishments.

-

Mobile accessibility and app integration

Additionally, accounting software is beginning to place more and more emphasis on mobile compatibility and app integration. Many accounting software packages provide mobile apps to enable businesses to access financial data while on the go. Establishments can streamline processes and increase productivity by integrating apps.

-

Increased focus on user experience

Finally, user experience is becoming a bigger concern in accounting software. Software is being created by vendors that are more user-friendly, intuitive, and customizable. By doing this, establishments can make the most of their accounting software and guarantee that staff members are utilizing it efficiently.

Average Cost of Accounting Software

The price of accounting software for small firms is anticipated to stay low as 2024 approaches. Many of the top accounting software services provide basic reporting and invoicing features as part of their free or low-cost pricing options. But more sophisticated functions, such as payroll processing, bill and expenditure management, and inventory monitoring, may be needed by organizations with more complex needs, driving up the price of accounting software.

One-time license prices for accounting software begin at roughly $96 and can go as high as $999 per user each month. You should budget closer to $375 per person per month, or $1,000+ for a license, for more comprehensive accounting systems.

Manufacturing accounting software is a vital tool for any successful firm because of its advantages, which include processing bills, monitoring cash flow, and precisely forecasting tax liabilities. To select which accounting application is appropriate for their company, business owners need to thoroughly assess their unique needs.

Conclusion

In conclusion, it's important to carefully evaluate your unique demands when looking for the best accounting software for your establishment. There are several alternatives available, whether you require invoicing, cost monitoring, financial reporting, or payment processing. Choosing the best supplier for you can be overwhelming, with so many offering distinctive advantages.

However, conducting in-depth research on alternatives like WaveApps, Netsuite, FreshBooks, Zoho Books, and QuickBooks will help you recognize the one that best meets your company's needs. To ensure client happiness, always take advantage of the free trials before investing and read user evaluations. The correct accounting software will ultimately save you time, cut down on errors, and improve the effectiveness of your financial management process.

Related Research Articles:

- 15 Best Accounting Software for Mac

- Accounting Practice: Definition, Types, and Principles

- 13 Accounting Trends in 2024 and Beyond

- Benefits of Hotel Accounting Software

- Why Mobile Accounting Is the Future for CPAs

- Top 6 Checklist of Accounting Software Evaluation

- Differences Between ERP Accounting Software

- Excel Alternatives for Accounting

- Excel Accounting Software - The Ultimate Guide

- Computerized Accounting System Software – Advantages and Disadvantages

- A Comprehensive Guide To Blockchain Accounting

- 8 Accounting Cycle Steps: An Easy Layman’s Guide

- Account Reconciliation: Process and Best Practices

- Accounting Information System (AIS): Definition, Function & Types

- What Are Adjusting Entries? Benefits, Types & Examples

- Integrated Accounting System: Features and Benefits

- How To Develop A Petty Cash Management System? 8-Step Guide

- Petty Cash: A Complete Guide [+ Downloadable Templates]

- 15 Must-Have Accounting Automation Software in 2024

- Accounting Data Analytics – Benefits, Challenges, & Latest Trends

- E-commerce Accounting: Comprehensive Guide for Business Owners

- Accrual Accounting: Definition, Benefits, and Examples

- Managerial Accounting: Types, Importance, Scope, and Techniques

- Accounting Department – Definition, Function, and Structure

- 10 Best Project Management Accounting Software

- Ethics in Accounting – Importance & Principles to Follow

- Financial Accounting vs Managerial Accounting: Key Differences

- The Difference Between Bookkeeping and Accounting

- Top 10 US Accounting Software in 2024

- Risk Management in Accounting: A 5-Step Guide in 2024

- Three Golden Rules of Accounting

FAQs

Accounting software helps to record transactions, download financial statements and reports, manage customer information, send invoices, share financial information with an accountant and file business taxes.

Unlike bookkeeping software, accounting software performs all of the functions of bookkeeping along with more analytical accounting functions, such as cash flow analysis and forecasting. In contrast, bookkeeping software focuses on data entry and storage. It is used to keep track of your revenue and expenses.

Accounting software eliminates up to 40% of business losses caused by accounting errors, but you have to know which accounting processes can be automated effectively and which ones cannot. For example, accounting software automates invoices, payroll, expense reports, etc.

Accounting software works by automating and streamlining financial management tasks such as invoicing, expense tracking, payroll management and reporting.

ERP (Enterprise Resource Planning) software encompasses a broader range of functions beyond accounting, integrating various business processes like HR, inventory, and sales. Accounting software solely manages financial transactions and reporting, making it a subset of ERP systems focused exclusively on financial aspects.

By Countries

By Cities

By Industries

- Accounting & CPA

- Advertising

- Agriculture

- Banking

- Construction

- Consulting

- Distribution

- Education

- Engineering

- Food & Beverage

- Government Contractors

- Healthcare

- Hospitality

- Insurance

- Legal-Law Firm

- Manufacturing

- Pharmaceuticals

- Property Management

- Real Estate

- Transportation

- Travel

- Farming

- Trading

- Textile

- Financial

- Sales

- Service

- Garment

- Fitness

- Government

- eCommerce

- sport

.png)

.png)

.jpg)